IBM Shines with Strong Financial Results in Q4 2024

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

International Business Machines Corporation, or IBM, reported its fourth-quarter 2024 results, showing better-than-expected adjusted earnings and revenue figures, surpassing estimates from Zacks Consensus.

Cloud and AI Drive Growth for IBM

IBM is experiencing growth primarily fueled by its analytics, cloud computing, and security solutions. The increasing use of traditional cloud-native workloads and generative AI services has led many companies to manage more complex cloud infrastructures. This complexity encourages businesses to adopt cloud-agnostic and interoperable strategies for better security, increasing the demand for IBM’s hybrid cloud offerings.

IBM’s acquisition of HashiCorp enhances its ability to help companies tackle complicated cloud environments. HashiCorp’s tools will work synergistically with IBM RedHat’s offerings, enhancing cloud infrastructure management. Furthermore, acquisitions like StreamSets and webMethods have strengthened IBM’s AI and automation platforms, uniting key skills in integration, API management, and data handling. These strategic buys enable IBM to deliver comprehensive application and data integration solutions in a competitive market.

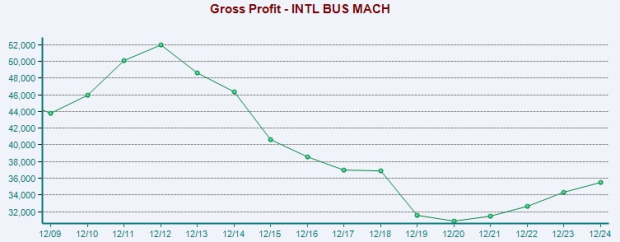

IBM Reports Improved Profit Margins

Despite challenges like geopolitical instability and cybersecurity threats, IBM has enhanced its profit margins over recent quarters. Gross profit in Q4 2024 climbed to $10.44 billion from $10.23 billion in the prior year’s quarter, translating to gross margins of 59.5% compared to 59.1% due to a strong product mix. Solid business restructuring, operating efficiency, and increased investment in growth are expected to support future profitability, leveraging advanced technology and deep consulting insights.

Image Source: Zacks Investment Research

Focus on Watsonx Platform

The Watsonx platform will play a central role in IBM’s AI strategy moving forward. This enterprise-focused AI platform includes products designed to help companies leverage AI effectively: the watsonx.ai studio for developing foundation models, the watsonx.data storage solution with an open lake house architecture, and the watsonx.governance toolkit to promote responsible AI workflows.

Positive Estimate Trends for IBM

Currently, IBM is seeing a rise in earnings estimate revisions. Predictions for 2025 have increased by 2.1% to $10.78 in just the past week, while estimates for 2026 rose 2.4% to $11.40. This trend suggests a growing confidence in the company’s future performance.

Image Source: Zacks Investment Research

IBM’s Stock Performance

Thanks to its strong quarterly results, IBM’s stock price has increased by 44.2% over the past year, significantly outpacing the industry’s growth of 3.1%. Compared to competitors such as Microsoft Corporation MSFT and Amazon.com, Inc. AMZN, IBM has demonstrated notable performance in the market.

One-Year IBM Stock Price Performance

Image Source: Zacks Investment Research

Summary

With robust fundamentals and significant revenue-generating potential, driven by strong market demand, IBM appears to be a solid investment opportunity. A continued focus on hybrid cloud solutions, effective operational strategies, and artificial intelligence is likely to enhance value for customers. For 2025, IBM projects at least a 5% increase in revenues on a constant currency basis, supported by a strong product portfolio and ongoing productivity improvements.

The company has achieved a four-quarter average earnings surprise of 6.1%. Currently, IBM holds a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

With a history of strong earnings surprises and a favorable Zacks ranking, IBM appears poised for further stock price growth. Investors may find this upward trend advantageous.

5 Stocks Set to Double

Each stock chosen by Zacks experts is expected to grow by +100% or more in 2024. While not every pick will succeed, past recommendations have seen returns of +143.0%, +175.9%, +498.3%, and +673.0%.

This report highlights several stocks that overlooked by Wall Street, presenting an opportunity for early investments.

Today, See These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.