Marinus Pharmaceuticals has been making waves in the epilepsy medicine market with its breakthrough drug, Zalmy (ganaxolone) oral suspension, which received approval in the United States in 2022. The drug has seen strong sequential sales growth and robust payer coverage one year into its launch. Zalmy is designed to treat seizures associated with cyclin-dependent kinase-like 5 deficiency disorder (CDD), a rare form of genetic epilepsy.

Not only has Marinus been making significant strides in the US market, but its commercial partners in the EU, China, and other regions have also been making noteworthy progress in launching Zalmy.

The company is further broadening its horizons by evaluating ganaxolone for the treatment of other rare genetic epilepsies like tuberous sclerosis complex (TSC) and refractory status epilepticus (RSE).

Looking ahead, 2024 is expected to be a catalyst-rich year for Marinus. In the second quarter of 2024, the company anticipates an interim analysis with top-line data readout from the RAISE study, which evaluates IV ganaxolone for RSE. The progress is promising, with over 75% of the required patients already enrolled and full enrollment for the interim analysis expected to conclude in the first quarter of 2024.

Additionally, mid-2024 is earmarked for the release of top-line data from the phase III TrustTSC study on ganaxolone for TSC. As the sole product in phase III development for this indication, Marinus is poised for a breakthrough. The completion of both the RAISE and TrustTSC studies is expected in 2024, potentially leading to expanded indications and a significantly larger eligible patient population for Zalmy.

The potential of the ganaxolone franchise as a long-term growth driver for Marinus is undeniable, especially given the relative orphan status of the epilepsy market. This niche positioning could set Marinus on a trajectory for substantial long-term success.

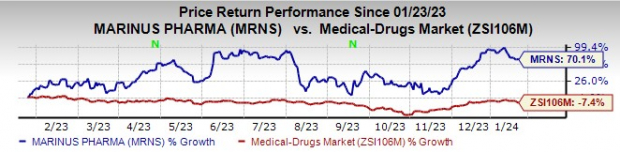

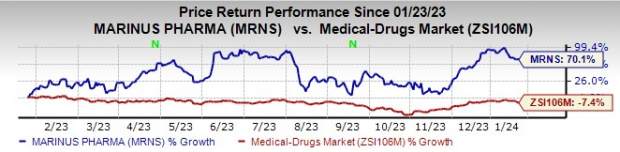

Investors have already taken notice of Marinus Pharmaceuticals. The company’s stock has surged 70.1% in the past year, outperforming the industry average, which saw a decrease of 7.4%.

Image Source: Zacks Investment Research

Furthermore, the consensus estimate for Marinus’ 2024 loss has narrowed from $2.43 per share to $2.27 per share over the past 90 days. With a Zacks Rank #2 (Buy), the company seems to be on a positive trajectory.

Marinus Pharmaceuticals, Inc. Price and Consensus

Marinus Pharmaceuticals, Inc. price-consensus-chart | Marinus Pharmaceuticals, Inc. Quote

Other Stocks to Consider

Among the top-ranked biotech companies worth considering are Regeneron Pharmaceuticals REGN, Puma Biotechnology PBYI, and Fusion Pharmaceuticals FUSN. Regeneron and Puma Biotechnology boast a Zacks Rank #1 (Strong Buy), while Fusion Pharmaceuticals holds a Zacks Rank of 2.

Regeneron, for instance, has seen optimistic growth and surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 12.34%. With estimates for its 2024 earnings on the rise and a stellar 27.8% stock surge in the past year, Regeneron presents an exciting investment opportunity.

Similarly, Puma Biotechnology has shown resilience, with improved earnings per share estimates and a 5.9% rise in its stock value over the past year. The company has exceeded earnings estimates in three out of the last four quarters, underscoring its potential.

In the case of Fusion Pharmaceuticals, despite a four-quarter average negative earnings surprise of 2.90%, the company has seen a remarkable 201% surge in its stock over the past year. With consensus estimates for its 2024 loss narrowing, Fusion Pharmaceuticals remains an intriguing prospect in the biotech space.

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Fusion Pharmaceuticals Inc. (FUSN) : Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.