Investors intrigued by the industrial juggernaut

3M

(NYSE: MMM) should mark their calendars for April 1. This is the day that the company is set to finalize the spinoff of its healthcare arm, Solventum. A generous 80.1% of Solventum shares will be distributed to current shareholders, with 3M holding on to the remaining 19.9% for future monetization within the next half-decade.

Given this imminent stock spinoff, the question lingers – is now the opportune moment to invest in 3M? Here’s why exercising patience until after April 1 might be the prudent path for those eyeing a position in either the beleaguered industrial conglomerate or its healthcare offshoot.

A Missed Chance for the Solventum Spinoff

Fresh off the board’s nod for the spinoff of its healthcare division, 3M anticipates Solventum to commence trading on the New York Stock Exchange under the ticker symbol SOLV post-April 1. Existing 3M shareholders will be entitled to one share of Solventum for every four shares of 3M held as of the record date on March 18.

The pivotal date of March 18 has sailed by, meaning investors buying 3M stock between now and April 1 may miss out on acquiring Solventum shares. With shares of 3M poised to split into two markets from March 26 to 28 – some with the right to Solventum shares and others without – it’s wiser to bide your time before diving in.

The Virtue of Waiting for Potential Savings

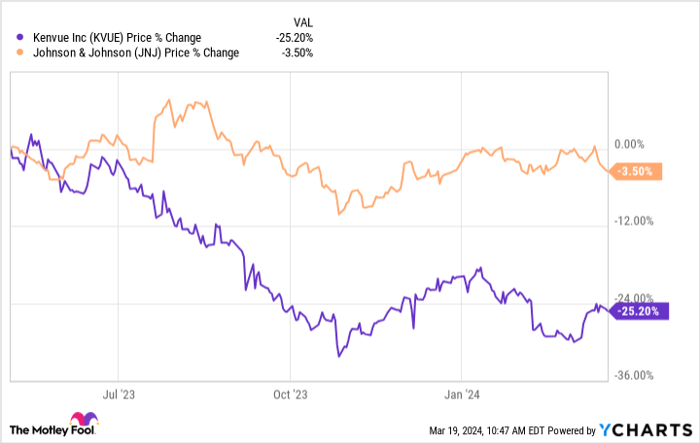

Another reason for caution is the chance to snag a better bargain on Solventum stock by exercising patience. Post-stock spinoffs, shares typically trend downwards as existing investors shed stock in the newly separated entity, a trend notably observed with

Johnson & Johnson

Kenvue consumer health products spinoff, as illustrated below:

KVUE data by YCharts

As illustrated, Kenvue witnessed a 25% value erosion since its split from Johnson & Johnson. Solventum could tread a similar path. Even those contemplating owning the remnants of 3M might secure a better deal by holding off, as selling pressure may mount due to investors divesting their remaining stake in the mainstay industrial giant.

Furthermore, a potential downside risk lurks post-spinoff. Following Solventum’s separation – contributing a quarter each to 3M’s revenue and earnings – a dividend reset might be in store for 3M. This was witnessed with

W.P. Carey

after splitting its office properties into a new office-focused REIT –

Net Lease Office Properties

last year. W.P. Carey trimmed its dividend by approximately 20% to align with scaled-down post-split earnings and a desire for a lower dividend payout ratio to fuel fresh investments. A parallel reset by 3M could be on the horizon, factoring in scaled-back earnings and dividend ratio to support new ventures, share repurchases, or bolstering its financial groundwork.

Prospects Post Spinoff

While prudence suggests waiting at present, there are enticing indicators to mull over post-Solventum spinoff. With a fresh CEO slated to take the reins in May, coupled with the electronics market on a path to recovery and the resolution of most legal entanglements, these catalysts could stimulate 3M’s limp valuation. Presently trading at a modest 11 times earnings – a stark contrast to the 19 times it commanded five years prior – 3M currently flaunts a generous 5.8% dividend yield. As the company orchestrates a turnaround in its ailing earnings and steers past legal hurdles, its valuation is poised for an uptick.

Time for Prudence

The window has shut for investors keen on securing Solventum shares via 3M stock purchases. In light of this, those eyeing either entity would be wise to defer acquisition till after April 1. This strategic restraint could pay dividends as share prices for both entities could slump post-spinoff. Moreover, prospective investors will have a clearer vision on 3M’s dividend trajectory.

Would investing $1,000 in 3M now be wise?

Before diving into 3M stocks, deliberate on the following:

The Motley Fool Stock Advisor analyst unit has singled out what they deem the 10 superior stocks for investors to consider, with 3M not making the shortlist. These picks are forecasted to yield substantial returns in the foreseeable future.

Stock Advisor provides investors a user-friendly roadmap to success, furnished with portfolio building pointers, timely updates from analysts, and two fresh stock suggestions monthly. Since 2002, the Stock Advisor service has tripled the returns of the S&P 500*

Check out the 10 stocks

*Stock Advisor returns as of March 20, 2024

Matt DiLallo holds positions in 3M, Johnson & Johnson, Kenvue, Net Lease Office Properties, and W.P. Carey. The Motley Fool holds and recommends Kenvue, Johnson & Johnson, and W.P. Carey and suggests the following options: extended January 2026 $13 calls on Kenvue. The Motley Fool maintains a disclosure policy.

The viewpoints and opinions expressed herein are those of the author and do not necessarily mirror those of Nasdaq, Inc.