The Stalwart Defender: CrowdStrike Remains in High Demand Despite Setback

The recent global computer outage caused by CrowdStrike, a cybersecurity software provider, sent shockwaves through the market. However, the company’s robust product offerings ensure its resilience. CrowdStrike boasts a comprehensive cybersecurity platform, with 28 modules covering various aspects of network protection. Its stronghold on the market is evident from the fact that a significant portion of its customer base heavily relies on multiple modules.

Despite the outage, CrowdStrike’s customer retention remained steady, with no mass exodus reported. The upcoming earnings report will provide a clearer picture of the incident’s impact. If the fallout is minimal, this crisis may well underscore the company’s ability to weather storms, further solidifying its status as an industry frontrunner.

The Price of Vigilance: Evaluating CrowdStrike’s Valuation Post-Dip

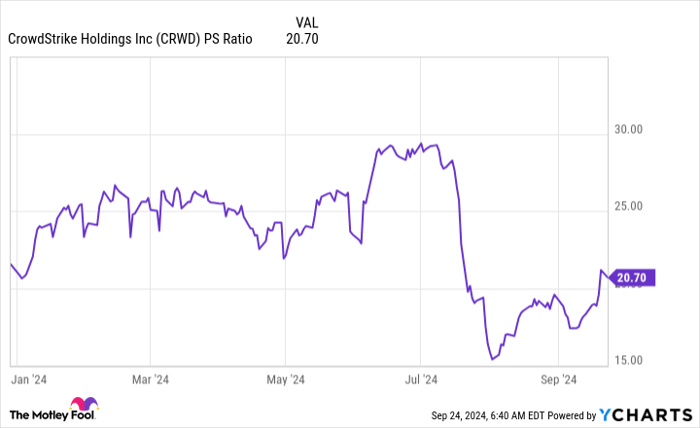

CrowdStrike, a long-time favorite in the cybersecurity sector, has traditionally commanded a premium in the market. Even after the recent stock plunge, its valuation remains on the higher side. While the price-to-sales ratio showed a decline, the stock’s current pricing still puts it in the expensive range.

Despite these considerations, CrowdStrike’s accelerated ARR growth indicates a promising future. The upcoming fiscal results will offer insights into the long-term implications of the outage. With cybersecurity software witnessing unprecedented demand, CrowdStrike’s trajectory may continue to be positive, making it a compelling investment choice.

Exploring Investment Opportunities

Considering an investment in CrowdStrike? The decision warrants caution and a thorough evaluation. While the stock is a top contender in the cybersecurity space, its valuation demands scrutiny. Investors without exposure to cybersecurity stocks might find CrowdStrike an attractive addition to their portfolio.

For potential investors, weighing the risks and rewards is paramount. While the recent slump may give pause, CrowdStrike’s enduring reputation in the industry and the sector’s growth potential could make it a viable long-term asset.