Encompass Health Corporation EHC is scheduled to release first-quarter 2024 results on Apr 24, 2024, after market close. An aging U.S. population, growing patient volumes and capacity expansion measures have been working well for the company, partially undone by rising costs.

Factors at Play

Revenues of Encompass Health have been benefiting on the back of improved patient volumes and higher discharge growth. Volumes receive an impetus from the company’s extensive geographical presence and favorable patient mix. We expect discharges to advance 7.2% year over year in the first quarter of 2024.

Revenue growth coupled with tactical cost-curbing initiatives drive adjusted EBITDA growth, which is estimated to witness 10.7% year-over-year growth in the to-be-reported quarter, per our model estimate.

An aging U.S. population, along with the need for effective rehabilitative services that empower individuals to resume daily activities, is likely to have sustained the solid demand for EHC’s services offered through its inpatient rehabilitation hospitals in the days ahead. We expect inpatient revenues at $1.2 billion in the first quarter, up 8.9% year over year.

Encompass Health’s investments targeted at capacity expansion remain well-timed to capitalize on a growing inpatient rehabilitative services market. The company has unveiled plans to construct inpatient rehabilitation hospitals across different U.S. communities and make them operable within a reasonable time. In this manner, EHC has been delving deeper into several U.S. communities grappling with inadequate care access.

To complement this endeavor, it has often taken the help of joint ventures with regional healthcare organizations. In the first quarter, Encompass Health formed a joint venture with the Georgia-based integrated health system, Piedmont, to build a 40-bed inpatient rehabilitation hospital in the state. It also disclosed plans to construct a 60-bed inpatient rehabilitation hospital in Arizona. EHC also adds beds to expand the operations of its existing facilities. With increased capacities, Encompass Health can cater to a higher number of patients and earn greater revenues in return.

On the back of an active expansion path, the healthcare portfolio of EHC currently comprises 160 hospitals spread across 37 states and Puerto Rico. A solid financial stand, substantiated by growing cash reserves and solid cash-generating abilities, has served as a cushion to the healthcare provider for pursuing uninterrupted business investments.

While all these tailwinds can make the stock a lucrative buy for investors, we remain concerned about the escalating trend observed in its operating expenses, particularly in the light of several expense management initiatives being undertaken. We expect total operating expenses to increase 9.5% year over year in the first quarter, thus affecting profit growth potential and making an earnings beat uncertain.

Price Performance

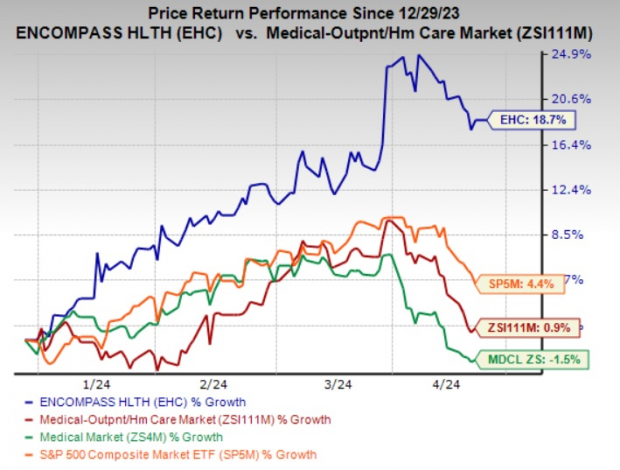

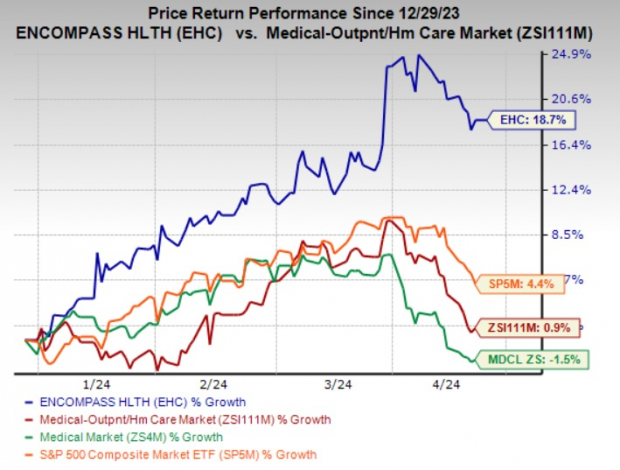

EHC’s shares have gained 18.7% year to date compared with the industry‘s 0.9% growth. The Medical sector declined 1.5% while the S&P 500 composite index increased 4.4% in the same time frame.

Image Source: Zacks Investment Research

Q1 Estimates to Watch

The Zacks Consensus Estimate for Encompass Health’s first-quarter 2024 earnings per share is pegged at 93 cents, indicating an improvement of 5.7% from the year-ago quarter’s reported figure. Encompass Health’s bottom line beat estimates in each of the trailing four quarters, the average surprise being 20.06%. The consensus mark for revenues is pegged at $1.3 billion, suggesting 9.5% growth from the year-ago quarter’s reported number.

Our proven model does not conclusively predict an earnings beat for Encompass Health this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here, as you see below.

Earnings ESP: Encompass Health has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: EHC currently carries a Zacks Rank of 2.

Stocks to Consider

While an earnings beat looks uncertain for Encompass Health, here are some companies from the Medical space, which according to our model, have the right combination of elements to beat on earnings this time around:

Lantheus Holdings, Inc. LNTH has an Earnings ESP of +4.29% and a Zacks Rank of 1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LNTH’s first-quarter 2024 earnings is pegged at $1.55 per share, which indicates an improvement of 5.4% from the year-ago quarter’s reported figure.

Lantheus’ bottom line beat estimates in each of the trailing four quarters, the average surprise being 14.84%.

HCA Healthcare, Inc. HCA has an Earnings ESP of +13.46% and a Zacks Rank of 2, at present. The Zacks Consensus Estimate for HCA’s first-quarter 2024 earnings is pegged at $5.01 per share, suggesting 1.6% growth from the year-ago quarter’s reported figure.

HCA Healthcare’s bottom line beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 9.78%.

Insulet Corporation PODD has an Earnings ESP of +11.11% and a Zacks Rank of 2, at present. The Zacks Consensus Estimate for PODD’s first-quarter 2024 earnings is pegged at 39 cents per share, which indicates an improvement of 69.6% from the year-ago quarter’s reported figure.

Insulet’s earnings beat estimates in each of the trailing four quarters, the average surprise being 100.09%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.