“`html

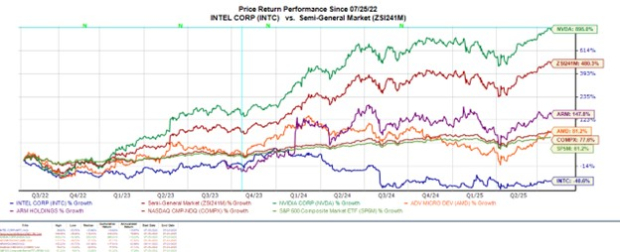

Intel Corporation (INTC) has seen its stock rebound by 15% in 2025, ahead of its anticipated Q2 results set to be released on July 24 . Despite this recovery, Intel’s stock remains down 40% over the last three years.

Intel is still one of the largest semiconductor companies globally but has lost market share to competitors like Nvidia (NVDA), AMD, and Arm Holdings. Q2 sales are expected to decline by 7% to $11.87 billion, down from $12.83 billion a year ago, with earnings projected at $0.01 per share, compared to $0.02 from the previous year.

Looking ahead, annual earnings for fiscal 2025 are expected to rise to $0.27 per share, recovering from an adjusted loss of -$0.13 last year. However, estimates for FY26 have declined by 37% over the past three months, from $1.12 per share to current forecasts.

“`