Visa’s Q2 Earnings Report: Expectations and Insights Ahead

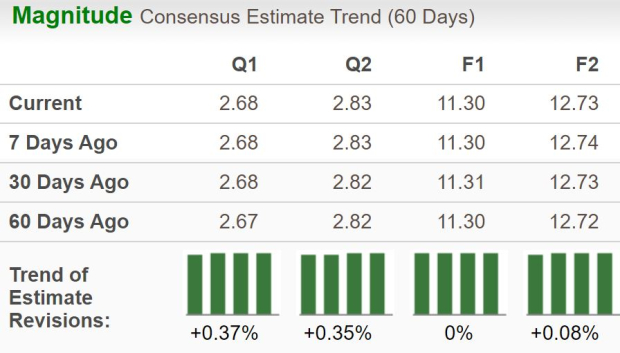

Visa Inc. (V) will announce its second-quarter fiscal 2025 results on April 29, 2025, after the market closes. The Zacks Consensus Estimate for this quarter’s earnings stands at $2.68 per share, with anticipated revenues of $9.56 billion. The estimate for fiscal second-quarter earnings has risen by 1 cent over the last 60 days, signaling an expected year-over-year growth of 6.8%. Furthermore, the revenue estimate indicates a 9% year-over-year increase.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Looking at the full fiscal year 2025, the Zacks Consensus Estimate for Visa’s revenues is set at $39.6 billion, reflecting a 10.2% year-over-year increase. The consensus for earnings per share (EPS) stands at $11.30, indicating projected growth of approximately 12.4% from the previous year.

Recent Earnings Performance

Visa has a solid track record of exceeding earnings expectations. The company has surpassed estimates in each of the last four quarters, with an average beat of approximately 3%.

Earnings Whispers for Q2

Our analysis suggests that Visa is likely to beat earnings expectations this quarter. The combination of a positive Earnings ESP and a Zacks Rank of #3 (Hold) supports this prediction. Visa currently has an Earnings ESP of +0.10% and a Zacks Rank of #3.

Key Factors Influencing Visa’s Q2 Results

The Zacks Consensus Estimate anticipates a 5.5% rise in total Gross Dollar Volume compared to the previous year, while our model forecasts a growth of 5%. The ongoing shift towards digital payment solutions is expected to bolster Visa’s results for the fiscal second quarter.

As Visa earns revenue based on a percentage of total transaction value from debit and credit card payments, higher consumer spending translates into increased revenues from transaction processing fees. The Zacks Consensus Estimate for total processed transactions suggests a 10.1% increase year-over-year, whereas our estimate is a 9.5% rise.

The estimate for total payment volumes indicates a 7.4% year-over-year growth, with expectations for U.S. operations alone increasing by 6%. Our projections for Latin America and CEMEA suggest year-over-year increases of 6.3% and 14.4%, respectively.

Additionally, the Zacks Consensus for data processing revenues proposes a 9.2% growth in the fiscal second quarter from $4.3 billion last year, while our estimate suggests a 9.9% increase. Similarly, for service revenues, the consensus indicates a growth of 9.1%, with our projections at 9.5%.

Also noteworthy is the estimate for international transaction revenues, projecting a 12.7% growth from the previous year; our model predicts a 10.8% rise. Continuous expansion in cross-border transaction volumes is likely a key contributing factor here.

These factors may lead to robust year-over-year growth for Visa in the fiscal second quarter. However, rising expenses and client incentives, which serve as contra-revenue items, may temper the overall impact of increased transaction volumes. We forecast that adjusted total operating expenses could rise over 10% year-on-year due to increased costs in Personnel, Marketing, Professional Fees, and Network and Processing expenses. Both the Zacks Consensus and our models estimate client incentives to be around $3.8 billion this quarter.

Visa’s Stock Performance and Valuation

Visa’s stock has decreased by 2.5% over the past month but has outperformed the industry and the S&P 500, which fell by 4.1% and 5.9%, respectively. Comparatively, peers such as Mastercard Incorporated (MA) and American Express Company (AXP) have declined by 2.5% and 3.2%, respectively, within the same period.

Price Performance – V, MA, AXP, Industry & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Turning to valuation, Visa appears somewhat stretched relative to the industry average. The company trades at a forward price-to-earnings ratio of 27.73X, higher than its five-year median of 26.92X and above the industry average of 22.52X. In comparison, Mastercard’s valuation is more inflated, trading at 31.97X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Visa’s Stability and Growth Potential Ahead of Q2 Earnings

Current Valuation and Market Position

As investors prepare for Q2 earnings, Visa’s stock valuation presents an interesting picture. With its current trading multiple at 16.76X forward 12-month earnings, it appears to be offering better value compared to peers in the sector.

Navigating a Volatile Economic Landscape

In a challenging macroeconomic environment, Visa distinguishes itself through a low-risk, transaction-based business model. This structure protects the company from direct credit risk and allows it to benefit modestly from inflation-driven price increases. The ongoing global transition from cash to digital payments has enabled Visa to maintain steady growth in both earnings and revenue. Furthermore, Visa invests heavily in areas such as real-time payments, B2B solutions, and blockchain. Together with robust shareholder returns via dividends and buybacks, these factors position Visa as a strong competitor for long-term growth.

Challenges and Considerations for Investors

Despite its strong fundamentals, Visa faces regulatory challenges alongside Mastercard. The industry is currently grappling with legal issues, increasing fee scrutiny, and competition stemming from legislative proposals like the Credit Card Competition Act. At present, Visa’s shares are trading close to their 52-week high and exceed historical valuation averages. As such, while it remains a compelling hold for existing investors, those considering new investments might want to watch for more favorable entry points, especially in light of the upcoming earnings results and ongoing legal uncertainties.

In summary, Visa’s stability and growth transactions make it appealing, particularly compared to risk-exposed alternatives. However, prospective investors should proceed cautiously while monitoring the evolving regulatory landscape.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.