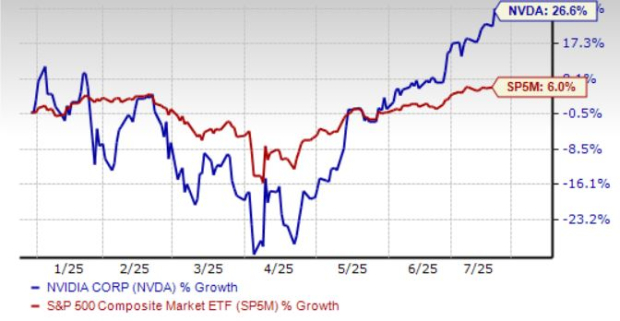

NVIDIA Corp. (NVDA) experienced a 4% increase in its stock price on July 15 after expressing optimism about resuming sales of its H20 AI chips to China, following earlier restrictions from the Trump administration. NVDA is currently the only publicly traded company with a market capitalization exceeding $4 trillion.

The company reported a loss of $2.5 billion in revenues from China in the first quarter of fiscal 2026, with management projecting an $8 billion revenue loss for the second quarter. Analysts estimate that resuming sales in China could yield an additional $10 to $20 billion in revenues for the rest of fiscal 2026, potentially translating to an earnings per share (EPS) increase of 25 to 50 cents.

NVIDIA forecasts a strong growth trajectory with expected revenue and earnings growth rates of 51.4% and 41.8%, respectively, for the current year, and 25.2% and 31.9% for the next year. The company’s automotive segment also saw a revenue increase of 72% year-over-year, anticipating revenues to exceed $5 billion in fiscal 2026.