Palantir Technologies: Volatile Stock Raises Investment Questions

Long-term investors typically avoid dwelling on a Stock‘s short-term price fluctuations. However, it is challenging to disregard the significant volatility experienced by Palantir Technologies (NASDAQ: PLTR) in 2025. The artificial intelligence (AI) Stock skyrocketed by as much as 1,840% since early 2023. However, following market volatility in February, the Stock quickly lost approximately 40% of its value from its peak. Such drastic shifts can emotionally tax investors.

Currently, the Stock appears to be recovering, as Palantir has regained about half of its recent losses. This development raises the question: Should you consider buying Palantir Stock now?

Where to invest $1,000 this minute? Our analyst team reveals their picks for the 10 best stocks available now. Learn More »

Palantir’s Growth Potential Appears Promising

Palantir specializes in creating custom software for both government and commercial clients. Its software employs analytics, machine learning, and artificial intelligence (AI) to convert organizational data into actionable insights swiftly.

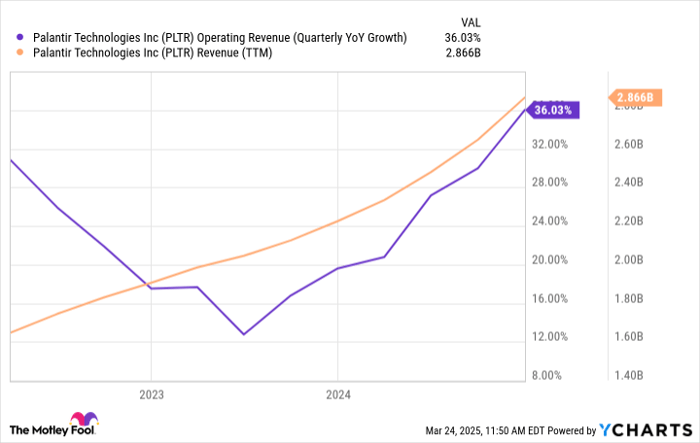

The versatility of Palantir’s software supports various applications, from optimizing supply chains to managing hospitals, detecting financial fraud, and assisting military intelligence. The company has witnessed accelerated growth since launching its AIP platform for AI applications in mid-2023:

Data by YCharts.

Investor enthusiasm for the Stock stems from the belief that the company’s growth trajectory will continue for years. With flexible technology, Palantir has a vast market opportunity ahead. In Q4 of 2024, Palantir’s customer base soared by 43% to 711. Given that there are approximately 20,000 companies in the U.S. with at least 500 employees, considerable potential remains for expansion within the private sector.

Historically, Palantir’s focus was primarily on government contracts, and it continues to grow in this area. Revenue from the U.S. government increased by 30% year over year in Q4, totaling $1.2 billion last year. Though Palantir’s revenue may not escalate indefinitely, it has undoubtedly cemented its position as a leader in AI software and its practical applications.

Valuation Concerns: Is Future Growth Already Factored In?

It is essential to differentiate between the Stock and the underlying business, as this is where some caution arises.

Since the beginning of 2023, the share price has surged approximately 1,400%, while Palantir’s trailing-12-month revenue only grew by 40% and net income increased by 213%. This disparity indicates that investors may be financing future business expectations rather than current performance.

This situation presents risks since prolonged periods allow more opportunities for setbacks. Growth could decelerate, or adverse market conditions could arise. Additionally, investors face opportunity costs, potentially missing returns elsewhere while awaiting Palantir’s business to align with its high share price.

The current price-to-sales ratio for Palantir stands at 81, a notably high valuation. Even Nvidia, a leading AI Stock over the past three years, peaked at a P/S ratio of 45. Palantir’s current valuation is nearly double that figure. Its price-to-earnings ratio exceeds 500, which many analysts consider irrationally high, especially given an estimated long-term earnings growth rate of just 25%. Even a robust annualized earnings growth of 50% would not justify this steep valuation.

Share Dilution: A Factor in Investment Returns

Another concern involves the company’s significant Stock-based compensation, which can lead to share dilution, negatively impacting per-share financial metrics and, consequently, investment returns over time. An increased number of shares means revenue and profits are divided among a larger shareholder base. Palantir’s $691 million in share-based compensation for the trailing 12 months equals a staggering 24% of revenue. In contrast, Nvidia’s Stock-based compensation accounted for just 3.7% of its trailing-12-month sales.

Is there potential for Palantir Technologies to reach new all-time highs? Certainly. The market can be unpredictable, and forecasting its movements is challenging. However, scrutinizing the fundamentals reveals that Palantir’s Stock is presently overvalued, making it vulnerable to further declines should investor sentiment shift negatively.

While Palantir Technologies holds appeal as a company, its Stock may not be a prudent purchase at this time. Investors might be better off waiting for a more favorable entry point, which could require a significant market pullback from the current price ranges.

Is it Wise to Invest $1,000 in Palantir Technologies Now?

Before making a decision to buy Stock in Palantir Technologies, it’s crucial to consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investment currently, and Palantir Technologies did not make this list. The 10 selected stocks have the potential to yield substantial returns in the years ahead.

For reference, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, that investment would be worth $739,720!*

Stock Advisor offers investors a straightforward strategy for success, providing guidance on portfolio management, ongoing updates, and two new Stock recommendations every month. The Stock Advisor has substantially outperformed the S&P 500 since 2002. Don’t miss the latest top 10 stocks available when you join Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of March 24, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.