Market Turmoil: Is Tesla Stock a Smart Investment Right Now?

Investors have experienced a tumultuous week. The Dow Jones, S&P 500, and Nasdaq Composite faced one of their worst multi-day declines in years. This turmoil is linked to an escalating trade war between the U.S. and major trade partners, including China and the E.U., in response to President Donald Trump’s substantial new tariffs on goods from multiple countries. However, market sentiment shifted to optimism following Trump’s decision to lower tariffs on all partners except China.

In light of the market chaos, some investors are considering buying stocks at what they perceive as discounted prices. A notable candidate for consideration is Tesla (NASDAQ: TSLA). The EV pioneer’s stock has dropped by over 6% since last Wednesday when the tariffs were announced, although it has since shown signs of recovery. Nevertheless, Tesla Stock is still down by almost 45% from its peak in January.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Despite its profitability—an advantage not shared by many competitors in the EV space—along with being a leader in autonomous driving innovations and significant growth in its energy storage business, questions arise: Is Tesla the ideal investment opportunity at this juncture?

Tesla: Primarily a Carmaker

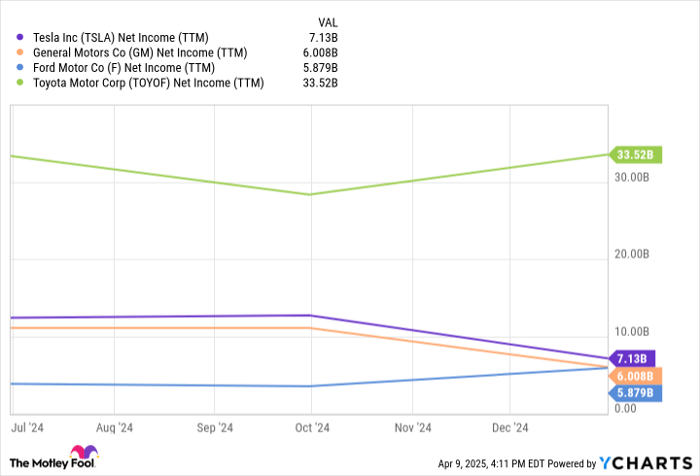

Currently, Tesla’s core business remains the manufacturing of cars. Out of the $97.7 billion in total sales the company reported last year, over $77.1 billion was generated from car sales alone. While rivals like Rivian and Lucid Group continue to struggle for profitability, Tesla stands among the top ten most profitable automotive companies globally. Although it still lags behind the highly profitable Toyota, Tesla outperforms American manufacturers such as GM and Ford.

TSLA Net Income (TTM) data by YCharts. TTM = trailing 12 months.

This profitability persists even amid declining sales. Tesla’s margins trump those of its domestic competitors, enabling the company to report substantial earnings despite their total sales being about half of GM and Ford’s. Consequently, there remains considerable growth potential—an encouraging sign for investors.

Declining Sales Figures

However, the troubling reality is that Tesla’s sales are not growing; in fact, they are declining. Tesla’s latest delivery report revealed that only 336,681 vehicles were delivered in the first quarter, marking the lowest delivery quarter since 2022. Although the next earnings call is still weeks away, signals from Tesla’s 2024 report indicate that the once robust double-digit year-over-year growth in revenue has vanished, with sales increasing by less than 1% from 2023 to 2024.

In some markets, the downturn appears to be accelerating. For example, Tesla’s sales in the E.U. plummeted by 45% in January, while the overall EV market grew by 37% year-over-year. Sales in China fell by 11.5% year-over-year in March, and numbers from France revealed their lowest sales level since 2021.

Several factors may be contributing to these trends, but notable is CEO Elon Musk’s increasing polarizing presence in both domestic and international politics over the past year. Leading the newly established Department of Government Efficiency (DOGE), Musk has implemented controversial domestic cost-cutting measures and engaged with local political issues in countries ranging from Germany to the U.K.

JPMorgan Chase analyst Ryan Brinkman notes that Musk’s actions may have led to “unprecedented brand damage,” a potential driver of Tesla’s declining sales. Concurrently, increasing competition from traditional manufacturers and the Chinese EV maker BYD have reduced the lead Tesla once held in consumers’ eyes as an industry pioneer.

Valuation Challenges for Tesla

Even if sales weren’t declining, the stock’s valuation presents a significant concern. Tesla’s stock trades at over 130 times earnings, an exceptionally high figure for any company, particularly a car manufacturer. This valuation greatly exceeds that of its competitors.

TSLA PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

While Tesla’s energy storage business is indeed thriving and the company is pursuing advancements in self-driving technology, the reality remains that Tesla is fundamentally a car manufacturer. The vast majority of its revenue stems from vehicle sales, and the potential for future transformative technologies can distract from this important fact.

Prospective investors should recognize that investing in Tesla means banking on a future that is uncertain. The stock’s current price far exceeds a reasonable expectation for a car company experiencing stagnating sales growth. I harbor reservations about Tesla meeting Musk’s ambitious promises within a meaningful timeframe or at all. Therefore, I conclude that Tesla Stock is not a worthwhile buy at this moment.

Miss Out on Potential Opportunities

Ever feel like you missed your chance to invest in successful stocks? It’s worth noting that our expert analysts occasionally issue a “Double Down” Stock recommendation for companies they predict will surge. If you’re worried about having missed your opportunity, now may be the perfect time to buy before it’s too late. The data tells a compelling story:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $287,670!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $37,568!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,226!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, available when you join Stock Advisor, and this opportunity may not arise again soon.

see the 3 stocks »

*Stock Advisor returns as of April 10, 2025

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool also recommends BYD Company and General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.