Tesla Prepares for Q1 2025 Earnings Call Amid Investor Scrutiny

Electric vehicle (EV) and technology leader Tesla (TSLA) is set to announce its first-quarter 2025 results on April 22, following market close. While analysts will seek details on whether earnings meet forecasts, investors are keen to hear CEO Elon Musk address burning questions regarding strategic initiatives. Key topics for discussion include progress on Full Self-Driving (FSD) updates, the launch of affordable EVs, advancements with the Optimus robot, and developments in artificial intelligence. The earnings call could shed light on Tesla’s current challenges, particularly as its stock faces pressure.

Quarterly Financial Expectations

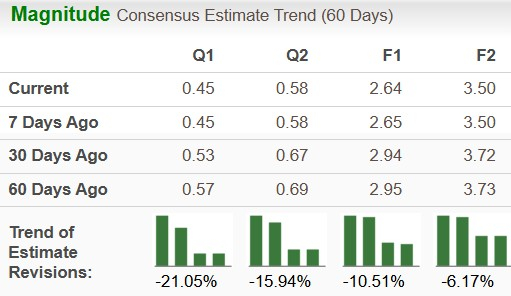

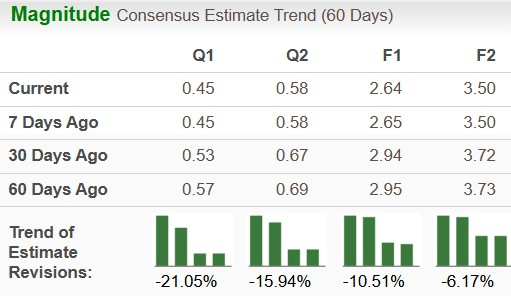

The Zacks Consensus Estimate anticipates earnings of 45 cents per share and revenues of $21.85 billion for the upcoming quarter. Over the past month, the earnings estimate has been revised down by 8 cents, showing no growth compared to the same quarter last year. Meanwhile, the revenue estimate suggests a modest increase of 2.6% year-over-year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For the full year of 2025, the consensus estimates set TSLA’s revenues at $104.8 billion, indicating a year-over-year growth rate of 7.3%. Additionally, the EPS estimate for 2025 sits at $2.64, reflecting around 9% growth from the previous year.

In the previous four quarters, Tesla missed EPS estimates three times and surpassed them once, with an average earnings surprise of 0.8%.

Tesla, Inc. Price and EPS Surprise

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

Insights on Tesla’s Q1 Performance

Currently, our model does not suggest that Tesla will deliver an earnings beat. Positive earnings expectations paired with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically signal better chances for beating estimates, which does not apply currently. TSLA holds an earnings ESP of -11.69% and a Zacks Rank of #4 (Sell).

Interested readers can also see the full list of Zacks #1 Rank stocks available here.

To stay informed on upcoming market-changing news, refer to the Zacks earnings Calendar.

Key Factors Influencing Q1 Results

In Q1, Tesla produced a total of 362,615 vehicles, including 345,454 Model 3/Y and 17,161 from other models. The company’s global delivery figures reached 336,681 units, with 323,800 Model 3/Y and 12,881 other types. This performance fell short of expectations of 409,584 units, displaying a drop of 32% and 13% sequentially and year-over-year, marking the lowest delivery figures in more than two years.

Factors such as reduced sales volume alongside significant discounts due to a competitive pricing environment are likely to impact automotive revenues and gross margins. Nevertheless, Tesla is reportedly making strides in lowering its cost of goods sold, which may help mitigate some of this pressure. Anticipations are for first-quarter gross margins on automotive sales to decrease from 17.8% in the previous year to 15.8%.

On a brighter note, the energy generation and storage sector has shown remarkable growth. In Q1 2025, Tesla deployed 10.4 GWh of energy storage products, reflecting a substantial 156% increase year-over-year. With strong demand for products like the Megapack and Powerwall, revenues in this segment are estimated to reach $3.1 billion—a 90% increase compared to last year—and gross profit is expected to more than double.

Additionally, Tesla’s Services/Other segment is projected to generate revenues of $3 billion, a 32% year-over-year increase, mainly due to the expansion of its supercharging network. Notably, major automotive players such as General Motors (GM) and Ford (F) are adopting Tesla’s NACS charging standard, which enhances this segment’s prospects.

Tesla’s Price Performance & Valuation Overview

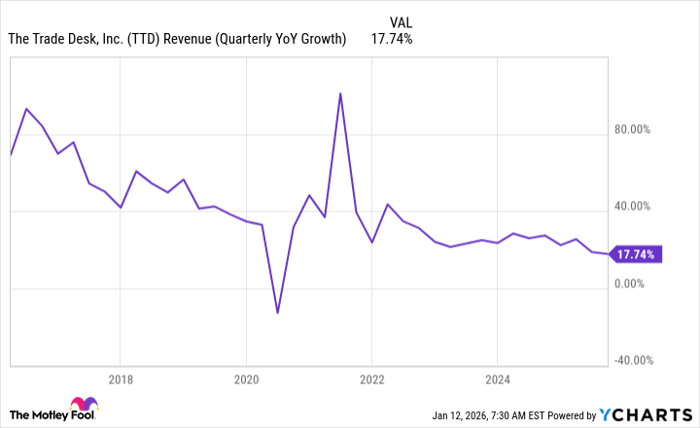

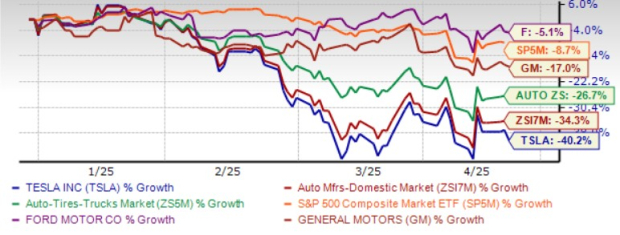

Year-to-date, Tesla shares have declined approximately 40%, underperforming peers in the industry, sector, and the S&P 500. This downward trend is particularly stark when compared to General Motors and Ford, which have seen reductions of 17% and 5%, respectively, during the same period.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, Tesla appears relatively expensive. With a forward price/sales ratio of 7.04, it surpasses the industry average of 2.18 significantly. The valuation is also notably higher compared to General Motors (P/S ratio of 0.25) and Ford (P/S ratio of 0.23).

Tesla’s Valuation Raises Concerns

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Moreover, Musk’s increasing political engagements have affected brand perception, contributing to declining sales in key markets including the United States, Europe, and China. Discontent among owners and rising backlash are raising concerns among investors.

Questions Investors Hope Musk Will Address

As Tesla approaches its Q1 earnings call, investors are eager for clarity on several pressing questions. Updates on the anticipated unsupervised FSD and Cybercab are crucial, alongside details about the timelines for more affordable models. With escalating global tensions and tariffs, how is the company positioning itself to adapt? Additionally, there’s mounting curiosity regarding the Optimus robot, as Musk previously claimed it could generate over $10 trillion in revenue potential. Does he stand by that estimate? Lastly, have there been any developments regarding licensing FSD technology to competitors? Investors are waiting for answers.

Investment Strategies for TSLA

Tesla Faces Pressure Ahead of Q1 Earnings Amid Increased Competition

Tesla’s core electric vehicle (EV) business is facing significant pressure from rising competition and sluggish demand. The allure that once surrounded the brand is waning. Elon Musk’s prominent involvement in the Department of Government Efficiency has raised concerns about his divided attention, particularly as Tesla navigates low sales and growing competitive challenges.

Focus on Autonomous Driving as a Path Forward

Tesla’s long-term strategy heavily emphasizes its ambitions in autonomous driving technology. The year 2025 is becoming increasingly critical for the company, as it must demonstrate effective operation of its autonomous vehicle (AV) technology without further delays. Achievements in Full Self-Driving (FSD) approvals and the development of a robotaxi service are essential milestones.

The company aims to roll out unsupervised FSD in Austin this June. Recently, Tesla secured the first of several necessary approvals to eventually launch its much-anticipated robotaxi service in California. These developments will play a vital role in shaping investor confidence moving forward.

Investor Caution Advised Ahead of Q1 2025 Earnings Call

Given the recent delivery disappointments, ongoing valuation concerns, and the potential for additional near-term weaknesses, investors might benefit from waiting for clarity during the first-quarter 2025 earnings call. If the results fail to impress and Musk’s comments do not restore confidence, Tesla’s stock could experience downward pressure. Therefore, conservative investors may want to remain on the sidelines or even consider reducing their exposure to the stock.

Learn More with Zacks Research

We’re not joking.

A few years ago, we surprised our members by giving them 30-day access to all our picks for just $1, with no obligation to spend more.

Thousands of investors took advantage of this offer, while others hesitated, thinking there must be a catch. Our aim is simple: we want you to explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others, which collectively closed 256 positions with double- and triple-digit gains in 2024 alone.

For those interested in the latest stock recommendations from Zacks Investment Research, you can download 7 Best Stocks for the Next 30 Days. Click here to access this free report.

Ford Motor Company (F): Free Stock Analysis report

General Motors Company (GM): Free Stock Analysis report

Tesla, Inc. (TSLA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.