“`html

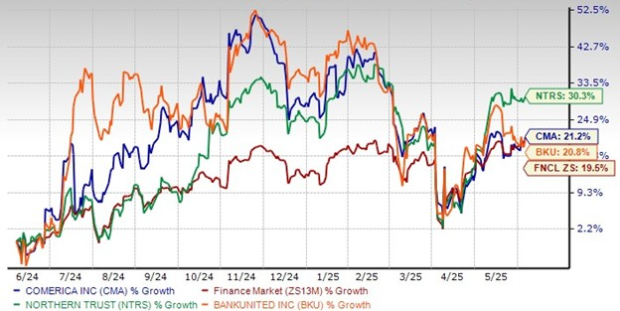

Comerica Incorporated (CMA) reported a share price increase of 21.2% over the past year, surpassing the industry average of 19.5%. In comparison, its peers, Northern Trust Corporation (NTRS) and BankUnited Inc. (BKU), recorded gains of 30.3% and 20.8% respectively.

As of March 31, 2025, Comerica’s total loans amounted to $49.9 billion, while its Common Equity Tier 1 (CET1) ratio stands at 12.05%, above regulatory minimums. The bank achieved a net interest income (NII) rise of 4.9% year-over-year in Q1 2025, with an expected growth rate of 5%-7% for the full year.

The company’s efficiency ratio improved from 76.91% to 70.28% year-over-year. Additionally, Comerica repurchased $50 million in stock and maintains a quarterly dividend of 71 cents per share, resulting in a dividend yield of 4.9%, outperforming its peers.

“`