Newmont Corporation Set for Earnings Boost Amid Rising Gold Prices

Newmont Corporation (NEM) is set to report its first-quarter results for 2025 on April 23, following the market’s close. The mining company is anticipated to benefit from an increase in gold prices despite facing cost pressures.

Q1 Earnings Forecast and Revenue Estimates

Over the past 60 days, the Zacks Consensus Estimate for first-quarter earnings has been adjusted upward. Currently, analysts predict earnings of 84 cents per share, reflecting a notable 52.7% increase year-over-year. Additionally, anticipated revenues for the quarter stand at $4.54 billion, indicating a gain of approximately 13% compared to the previous year.

Image Source: Zacks Investment Research

Historically, NEM has surpassed the Zacks Consensus Estimate in three out of the last four quarters, with an average earnings surprise of 34.5%.

Image Source: Zacks Investment Research

Analysis of NEM’s Earnings Outlook

Despite NEM’s strong track record, current market signals do not convincingly predict an earnings beat this quarter. For an earnings beat, a company typically needs a positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). Currently, NEM holds a Zacks Rank of #2, but with an earnings ESP of -4.55%, the outlook for a beat is less certain.

Investors can effectively track stock performance by utilizing the earnings ESP Filter available on Zacks.

Factors Influencing Q1 Performance

Higher gold prices are expected to play a significant role in shaping Newmont’s results this quarter. The demand for safe-haven investments has surged, especially given ongoing global trade tensions and economic uncertainties, pushing gold prices nearly 19% higher in Q1 alone and approximately 26% up for the year.

Newmont is likely to reflect this trend in its profitability, estimating average realized gold prices of around $2,759 per ounce, which represents a 32% year-over-year increase.

Additionally, production figures are projected to remain strong, with expected consolidated attributable gold production of roughly 1.54 million ounces for the quarter, thanks to its managed Tier 1 portfolio. However, increasing unit costs may dampen results. The company has indicated that AISC is expected to peak in Q1 due to costs tied to non-core asset production and sustained capital expenditures. Our AISC estimate sits at $1,691 per ounce, indicating a 17.5% rise from the previous year.

Stock Performance and Market Position

Over the past year, Newmont shares have climbed 47%, although this lags behind the Zacks Mining – Gold industry’s 58.3% increase and significantly exceeds the S&P 500 growth of 5.8%. Notably, its gold mining peers—Barrick Gold Corporation (GOLD), Agnico Eagle Mines Limited (AEM), and Kinross Gold Corporation (KGC)—have recorded gains of 22.8%, 95.2%, and 128.7%, respectively, in the same timeframe.

Image Source: Zacks Investment Research

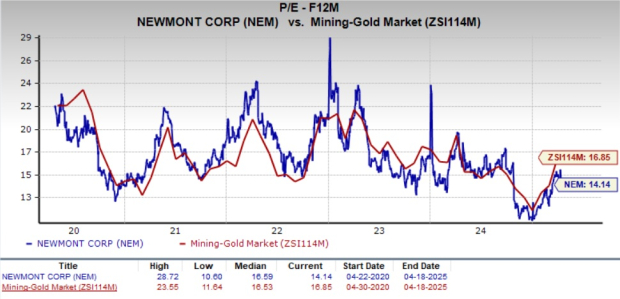

In terms of valuation, Newmont is currently trading at a forward 12-month earnings multiple of 14.14X, which is about 16.1% lower than the industry average of 16.85X.

Image Source: Zacks Investment Research

Strategic Outlook for NEM

Newmont is strategically positioned for growth through a strong portfolio of projects aimed at expanding production capacity and extending mine life, which will ultimately boost revenues and profits. The acquisition of Newcrest Mining Limited has further enhanced its portfolio, promising significant synergies and value for shareholders.

The company enjoys solid liquidity and generates substantial cash flows, allowing it to fund growth initiatives, meet short-term financial obligations, and enhance shareholder value. As a leading gold producer, Newmont is poised to capitalize on rising gold prices, which should favorably impact its profitability and cash flow generation.

Conclusion: Consider NEM Shares

Investing in NEM Stock prior to its earnings announcement is an appealing opportunity. This interest is driven by its strong market presence, robust financial health, promising growth prospects, increasing earnings estimates, favorable gold market conditions, and strategic investment efforts.

Newmont Corporation Positioned for Potential Gains Amid Rising Gold Prices

With the current upward trend in gold prices, Newmont Corporation (NEM) appears well-equipped to offer attractive returns for investors. This makes it a reasonable selection for anyone looking to benefit from the soaring gold market.

Expert Insights: Stock Likely to Experience Significant Growth

Zacks’ research team has identified five stocks with a high likelihood of achieving gains of 100% or more in the upcoming months. Among these, Director of Research Sheraz Mian has flagged one stock as particularly likely to see substantial growth.

This standout stock hails from one of the industry’s most innovative financial firms. It boasts an expanding customer base of over 50 million, coupled with a broad range of cutting-edge solutions that position it favorably for significant gains. While not all recommended stocks may succeed, this one holds the potential to greatly exceed previous Zacks recommendations, much like Nano-X Imaging, which surged by 129.6% in just over nine months.

For those interested in investment opportunities, Zacks Investment Research offers insights on various selections that could provide substantial returns.

Newmont Corporation (NEM): Free Stock Analysis report

Kinross Gold Corporation (KGC): Free Stock Analysis report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis report

Barrick Gold Corporation (GOLD): Free Stock Analysis report

This content originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.