Evaluating Investment Insights: Analyzing Nu Holdings Ltd. Recommendations

Before deciding to buy, sell, or hold a stock, investors often consider the insights of Wall Street analysts. However, how much credence should be given to their recommendations, especially when it comes to Nu Holdings Ltd.?

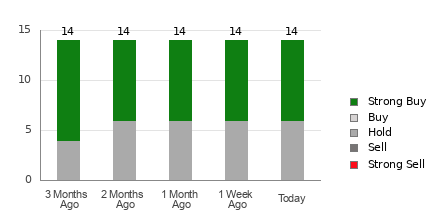

Currently, analysts rate Nu Holdings Ltd. NU with an average brokerage recommendation (ABR) of 1.82. This score, derived from 14 brokerage firms, sits between the Strong Buy and Buy categories.

Out of the 14 firms providing recommendations, eight have issued a Strong Buy rating, accounting for 57.1% of the total recommendations.

Understanding NU’s Brokerage Ratings

Though the current ABR suggests a buying opportunity, relying solely on this figure is not advisable. Studies indicate that brokerage ratings often do not effectively guide investors toward stocks likely to see significant price rises.

You may wonder why that is. Analysts frequently carry bias due to their firms’ interests, which means they tend to rate stocks more favorably than warranted. Research shows that for every “Strong Sell” recommendation, there are five “Strong Buy” ratings.

This disparity suggests that investors’ interests do not always align with those of brokerage firms, creating confusion regarding stock price predictions. It is therefore wise to use this information to support your analysis rather than base decisions solely on it.

A reliable approach could be utilizing the Zacks Rank, our proprietary rating tool with an excellent track record. It ranks stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering valuable insights into a stock’s short-term performance. Cross-referencing the Zacks Rank with the ABR may bolster investment decisions.

Clarifying the Differences: Zacks Rank vs. ABR

Despite both measures using a 1 to 5 scale, the Zacks Rank and ABR are distinctly different.

The ABR relies solely on brokerage recommendations, usually expressed in decimals (like 1.28). In contrast, the Zacks Rank uses a quantitative model based on earnings estimate revisions, showing results in whole numbers from 1 to 5.

Historically, brokerage analysts have tended to remain overly optimistic. Their ratings often do not align with actual research, misleading investors more than guiding them accurately.

In contrast, the Zacks Rank leverages earnings estimate trends, as empirical studies show a strong correlation between these trends and short-term stock price changes.

Furthermore, unlike the ABR, which may lag, the Zacks Rank responds quickly to earnings estimate changes, providing timely insights on potential stock movements.

Should You Invest in NU?

Evaluating the earnings estimates for Nu, the Zacks Consensus Estimate for this year currently stands at $0.41, unchanged over the last month.

The consistency in analysts’ outlook regarding Nu’s earnings performance suggests it may align with the broader market trends in the near future.

Given the stability of the consensus estimate, along with other key earnings factors, Nu holds a Zacks Rank #3 (Hold). Thus, it may be wise to exercise caution despite the attractive Buy recommendation indicated by the ABR.

To read this article on Zacks.com, click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.