Palantir Technologies Faces Challenges Despite Strong AI Demand

Palantir Technologies (NASDAQ: PLTR) saw its stock rise notably in 2024 as the demand for artificial intelligence (AI) software surged. Starting 2025 on a solid foundation, the stock reached an all-time high in mid-February. However, it has since declined by as much as 40%, currently trading around 14% lower. This drop can be linked to a broader stock market pullback, primarily driven by concerns over an escalating trade war.

Regardless of the recent price decrease, demand for Palantir’s AI software remains robust. A recent military contract highlights this ongoing strength. The AI software platform market is projected to reach $153 billion in annual revenue by 2028, indicating a compound annual growth rate of 41% over the next five years.

Investor Concerns Surrounding Valuation

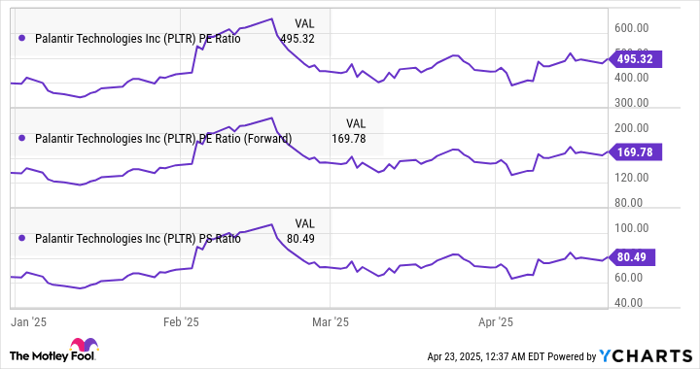

Palantir’s robust start to the year was partly overshadowed by valuation concerns. The stock was already considered expensive at the end of 2024, and it continues to trade at a premium valuation, illustrated in the chart below.

Data by YCharts.

With many investors prioritizing risk reduction amid economic uncertainty, Palantir stock may remain under pressure in the near term. This scenario could present a buying opportunity, as the company shows promising signs of justifying its high valuation.

Resilience Amid Macroeconomic Challenges

Despite a market sell-off fueled by trade tensions, Palantir shares are up 42% in 2025. This resilience reflects the company’s tariff-resistant business model. Although increased input costs from tariffs might prompt clients to reduce spending, Palantir’s Artificial Intelligence Platform (AIP) is designed to enhance efficiency and mitigate potential cuts.

Palantir’s AIP integrates generative AI solutions into business processes, enabling customers to significantly decrease operating expenses or boost productivity, as reported in the February earnings conference call. Chief Technology Officer Shyam Sankar shared examples of successful implementations:

We have been collaborating with a large multinational bank to automate essential back-office tasks. Processes that previously took five days now only take three minutes. Beyond labor savings, this efficiency allows the bank to create new and differentiated financial products. Similarly, we’re working with a leading engineering and construction firm to automate risk identification across extensive technical documentations, replacing manual month-long reviews with AI analysis that identifies major risks in minutes.

As a result, Palantir’s clients are increasingly utilizing its software and entering into larger contracts. In fact, Palantir’s total contract value surged by 56% year-over-year in the fourth quarter of 2024, reaching $1.8 billion—outpacing the 36% growth in revenue during the same period.

Additionally, Palantir’s earnings demonstrated significant growth, climbing 75% compared to the prior year. This level of earnings growth indicates that larger contracts from existing customers require less investment in acquiring new business, contributing to improved unit economics.

As a result, Palantir appears poised to surpass Wall Street’s growth expectations. Analysts forecast a 35% rise in earnings for 2025, with recent estimates trending upward.

Data by YCharts.

Palantir holds a significant revenue pipeline valued at $5.4 billion, as evidenced by its remaining deal value at the end of 2024. This metric, reflecting the total value of contracts yet to be fulfilled, rose by 40% year-over-year in Q4 due to an increase in signed contracts. The vast opportunity in the AI software market positions Palantir favorably to gain additional business moving forward.

As one of the leading players in this rapidly expanding space, Palantir is helping clients enhance productivity and cut costs through AI. The company continues to show growth potential, suggesting its stock may be worth considering as it seeks to deliver robust performance that can validate its valuation.

Should You Invest in Palantir Technologies Now?

Before making any investment decisions regarding Palantir Technologies stock, it is important to consider current market insights:

Despite its potential, Palantir Technologies is not included in the recent recommendations from leading analysts. The focus is on identifying stocks with higher immediate upside potential.

Overall, Palantir’s position in the AI market remains strong, offering the prospect of solid performance even amidst macroeconomic challenges.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.