“`html

Wall Street’s Take on Workday: Navigating Buy, Sell, and Hold Recommendations

Investors often rely on Wall Street analysts’ ratings before making decisions about stocks. While news about these ratings can impact a stock’s price, how much do they really matter?

Let’s examine what the leading analysts are saying about Workday WDAY. We’ll also explore the reliability of these recommendations and how investors can make the most of them.

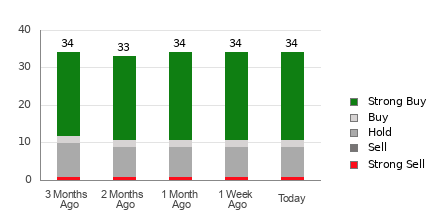

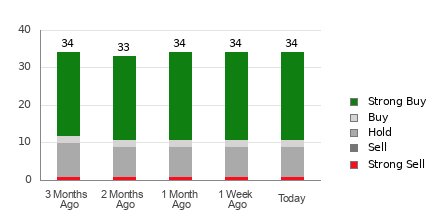

Currently, Workday has an average brokerage recommendation of 1.65 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on insights from 34 brokerage firms. This rating leans closer to a Strong Buy than to a Buy.

Among the 34 ratings contributing to this average, 23 are Strong Buy and 2 are Buy, representing 67.7% and 5.9% of all ratings, respectively.

Understanding Workday’s Rating Trends

The average brokerage recommendation indicates a buying opportunity for Workday. However, relying solely on this data for investment decisions may not be wise. Studies show that recommendations from brokerage firms often lack success in helping investors identify stocks that will rise in value.

Why is this the case? Brokerage firms often have vested interests in the stocks they cover, leading their analysts to display a positive bias in their ratings. Research indicates that for every “Strong Sell” rating, there are about five “Strong Buy” recommendations.

This bias suggests that analysts’ interests may not align with individual investors, making it difficult to predict a stock’s true trajectory. Therefore, brokerage ratings might best serve as a way to confirm your own research rather than as standalone indicators.

For more reliable insights, consider the Zacks Rank, which is an externally audited rating system that assesses stocks based on earnings revisions. The Zacks Rank grades stocks on a scale from 1 (Strong Buy) to 5 (Strong Sell), providing valuable input for investors considering Workday.

Distinguishing Between Zacks Rank and Average Brokerage Recommendation

While both the Zacks Rank and the Average Brokerage Recommendation (ABR) are rated on a scale from 1 to 5, these are fundamentally different measures.

The ABR is calculated based entirely on broker recommendations, typically shown in decimal form (e.g., 1.28). In contrast, the Zacks Rank is based on earnings estimate revisions, expressed in whole numbers.

Brokers tend to overly favor certain stocks, issuing ratings that can mislead investors. This contrasts with the Zacks Rank, which is influenced solely by the latest earnings estimates, reflecting real-time trends. Research shows a strong link between these earnings revisions and stock price movements.

Moreover, the Zacks Rank constantly adjusts to reflect current earnings estimates from brokerage analysts, ensuring it remains timely and accurate for predicting stock behavior.

Evaluating Workday as an Investment

For Workday, the Zacks Consensus Estimate for the current year has risen by 0.2% over the past month, now standing at $6.97.

This optimistic outlook, as shown by analysts increasing their earnings estimates, points to potential stock growth in the near future.

The combination of this estimate change and three additional earnings-related factors has earned Workday a Zacks Rank of #1 (Strong Buy).

Thus, while the Average Brokerage Recommendation is useful, the Zacks Rank may offer deeper insights for making informed investment choices.

To read this article on Zacks.com click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

“`