Stanley Druckenmiller Takes a New Stance on Amazon

Stanley Druckenmiller and his Duquesne Family Office have become a notable hedge fund for investors to watch. With over $100 million in assets, the fund is required to report its holdings to the Securities and Exchange Commission each quarter. This information is then available to the public via a 13F form 45 days later, allowing observers to track its investments.

In the fourth quarter, Druckenmiller initiated a new investment in Amazon (NASDAQ: AMZN). Prior to this period, he held no shares of Amazon. The fund acquired $72 million worth of Amazon shares during the quarter, representing about 2% of the total portfolio value. Given Amazon’s current strengths, this decision appears to be well-founded.

Key Divisions Driving Amazon’s Value: Cloud Computing and Advertising

When considering Amazon, many instantly think of its e-commerce platform. While this is the most visible part of the company, other components offer stronger growth potential.

Notably, e-commerce, although still crucial, has limited growth opportunities. In the fourth quarter, revenue from the online stores segment grew by a modest 7% year-over-year, totaling $75.6 billion. While this remains Amazon’s largest segment, it grew slower than other sectors such as Alphabet’s ventures. Instead, attention should be directed toward Amazon Web Services (AWS) and advertising.

The contributions from AWS and advertising have surged, collectively generating $46.1 billion in revenue during the fourth quarter. AWS recently surpassed advertising as Amazon’s fastest-growing segment, with revenue growing by 19% year-over-year compared to an 18% increase in advertising. The profitability of these segments is a significant advantage for Amazon.

Although Amazon doesn’t specify the profitability of its subscription services, comparable companies like Alphabet and Meta Platforms achieve considerable revenue from ads, enjoying higher profit margins than traditional retail firms. This implies an enhancement in Amazon’s profitability as well.

Fortunately for investors, Amazon does report its AWS financials separately. In the latest quarter alone, AWS produced $10.6 billion in operating profits, accounting for 50% of the company’s total operating profits—a clear indication of its contribution to Amazon’s overall income.

The impact of AWS extends beyond these figures, especially during the bustling holiday season, which often results in higher profits across divisions. Analyzing the operating income for the past year, AWS’s share of Amazon’s operating profit climbs to an impressive 58%. With AWS expected to continue its growth trajectory, it will likely become an essential aspect, defining Amazon’s business landscape in the coming years.

Understanding this dynamic likely influenced Druckenmiller’s decision to invest during the fourth quarter. But the question remains: Is Amazon a smart investment at its current price?

Current Stock Valuation of Amazon

The snapshot of the Duquesne Family Office, recorded on December 31, 2024, is only now revealing Druckenmiller’s latest moves. Since the start of 2025, Amazon’s stock has seen a slight rise of approximately 3%, indicating relative stability in its price.

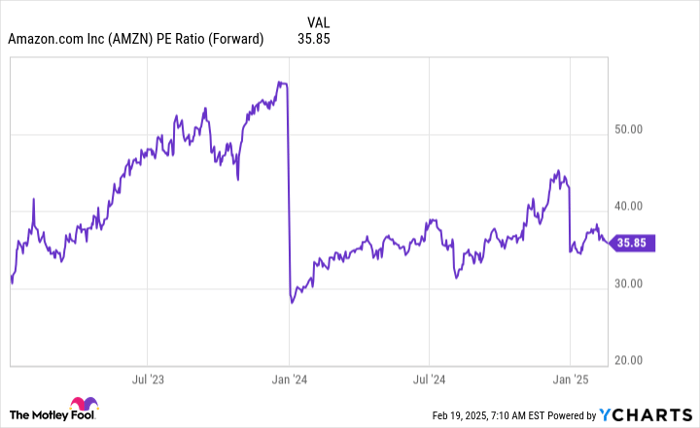

In terms of valuation, Amazon trades at 36 times its forward earnings.

AMZN PE Ratio (Forward) data by YCharts

This isn’t an inexpensive stock by any means, but it is more attractive compared to past valuations. Furthermore, the forward price-to-earnings ratio (P/E) does not fully reflect the potential, as CEO Andy Jassy and his team are still enhancing the profitability of the commerce division.

Investors recognize that Amazon’s most rapidly growing segment, AWS, operates with significantly higher profit margins than its traditional retail base. With this growth trajectory, profit margins are expected to rise over the coming years.

Consequently, it’s possible that Amazon’s profit outlook may transform considerably over the next five years. This long-term potential is why savvy investors like Druckenmiller are willing to enter a stock that may seem priced high compared to other major technology stocks. Therefore, for those who are patient and willing to hold on for three to five years, Amazon could be a promising investment.

Is Now the Right Time to Invest in Amazon?

Before diving into an investment in Amazon, it’s worth noting this:

According to the Motley Fool Stock Advisor analyst team, they have identified their 10 best stocks for investment right now, and Amazon is not included in that list. The highlighted stocks have the potential to yield significant returns in the future.

For context, when Nvidia was named on the list on April 15, 2005, a $1,000 investment then would have grown to a whopping $858,668 today.*

The Stock Advisor service simplifies investing by offering guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since its inception, the service has more than quadrupled the returns of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also a board member. Suzanne Frey, an executive at Alphabet, is a member of the board, along with Keithen Drury, who holds positions in Alphabet and Amazon. The Motley Fool recommends Alphabet, Amazon, and Meta Platforms and has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.