“`html

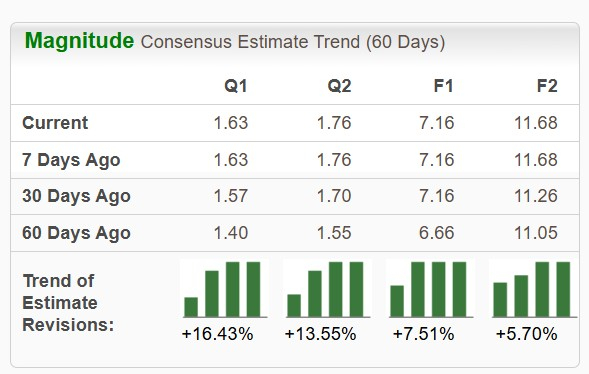

Prologis (PLD) is set to leverage its strategically located modern distribution facilities, expecting a year-over-year rental revenue increase of 6.3% in 2025. The company reported $811 million in acquisitions during Q1 2025 and anticipated a total acquisition share of $750 million to $1.25 billion for the year, along with development starts estimated between $1.5 to $2.0 billion. As of March 31, 2025, Prologis maintained a strong balance sheet with $6.52 billion in liquidity and a total consolidated debt of $32.26 billion.

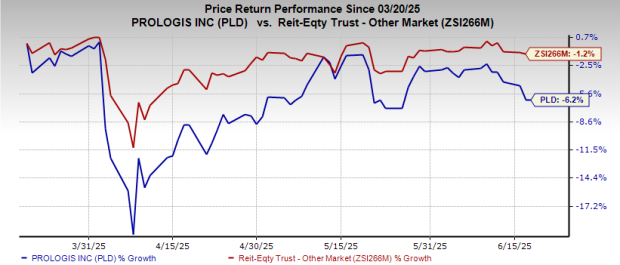

However, the company faces challenges from macroeconomic conditions and elevated interest rates, leading to customer cost controls and delayed lease decisions. Despite an overall positive outlook, Prologis shares have declined by 6.2% over the past three months, while the interest expenses are projected to increase by 11.7% year-over-year in 2025.

“`