Atlassian Stock Declines: Should Investors Hold or Sell?

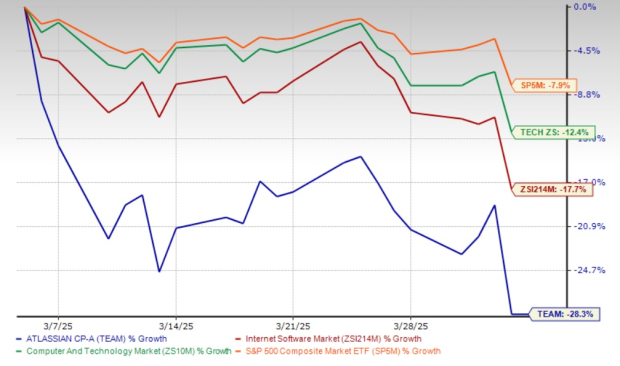

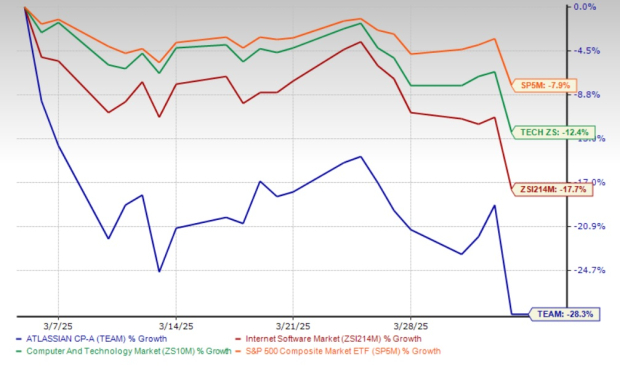

Atlassian (TEAM) shares have fallen 28.3% over the past month. This contrasts sharply with the declines seen in the Zacks Computer Technology sector (12.4%), Zacks Internet Software industry (17.7%), and the S&P 500 (7.9%).

This drop prompts an important question for investors: Should you cut your losses or continue to hold? While short-term challenges are pressing, Atlassian’s long-term growth narrative remains strong, supporting the case for maintaining your investment in this stock.

Atlassian One Month Price Performance Chart

Image Source: Zacks Investment Research

Factors Influencing Atlassian’s Recent Decline

Various factors have contributed to TEAM’s dip, including broader market trends and growing anxiety over potential tariffs. These tariffs could increase the costs of data center services and networking equipment essential to Atlassian’s operations, thereby squeezing margins.

Moreover, a significant portion of Atlassian’s software development workforce is located abroad. Increased tariff rates could lead to higher costs for cross-border services and software imports, further impacting the company’s bottom line.

Investor sentiments are also weighed down by the observation of declining sales growth. Atlassian, which recorded revenue growth rates in the mid-30% range during fiscal 2022, has reported growth in the low-to-mid 20% range in recent fiscal periods.

Atlassian Faces Rising Competition

Atlassian, despite its strong position in collaboration and workflow software, contends with fierce competition from industry giants like Monday.com (MNDY), Microsoft (MSFT), Alphabet (GOOGL), Salesforce, and IBM.

Competing products include Atlassian’s JIRA, which stands alongside Microsoft’s Azure DevOps Server and IBM’s Rational. The Confluence product faces similar competitors like Salesforce Chatter, Microsoft Teams, and Google Docs/Workspace. Additionally, Monday.com is set apart by offering a wider array of workflow features compared to Trello.

The growing competition could pressure Atlassian to lower its prices or increase investments in research and development, thereby affecting profit margins. For fiscal 2025, Zacks Consensus Estimates predict Atlassian’s earnings per share at $3.47, with an expected year-over-year growth of 18.4%.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Nevertheless, there are positive signs for Atlassian.

AI and Cloud Adoption Drive Atlassian’s Growth

The incorporation of AI across JIRA, Confluence, Bitbucket, and Trello is paying off as Atlassian sees a rise in customers opting for higher-value AI solutions. This approach has led to a 40% year-over-year uptick in sales for the Premium and Enterprise editions.

Additionally, Atlassian pursues a cloud migration strategy aimed at transitioning customers to a subscription-based pricing model, which ensures strong recurring revenues and top-line stability.

TEAM is also nearing its goal of securing FedRAMP Moderate Authorization. This certification will allow more U.S. government agencies and other regulated enterprises to utilize Atlassian’s cloud offerings, facilitating further revenue growth.

Conclusion: Retain Atlassian Stock for Now

While Atlassian faces regulatory, macroeconomic, and competitive pressures, the company continues to innovate its product suite to foster future growth. With its focus on AI and cloud strategies, there is a consistent revenue flow expected. In light of these factors, we recommend that investors maintain their positions in this Zacks Rank #3 (Hold) stock at this time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

New analysis reveals 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, identified as “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market more than twice with an average gain of +23.9% per year. Don’t miss these 7 handpicked stocks.

See them now >>

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Microsoft Corporation (MSFT) : Free Stock Analysis report.

Alphabet Inc. (GOOGL) : Free Stock Analysis report.

Atlassian Corporation PLC (TEAM) : Free Stock Analysis report.

monday.com Ltd. (MNDY) : Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.