“`html

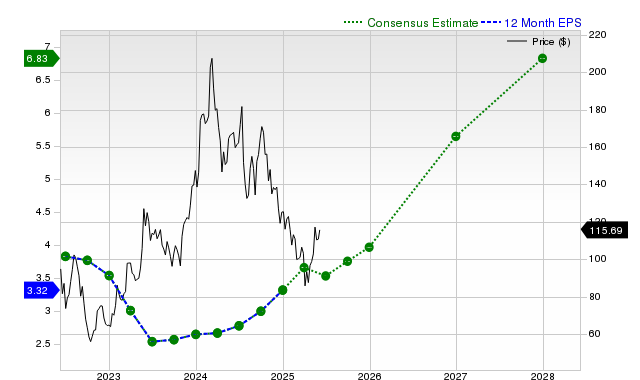

Advanced Micro Devices (AMD) has seen a 13.8% increase in its stock value over the past month, outperforming the Zacks S&P 500 composite’s +5.3% gain and the Computer – Integrated Systems industry’s +15.2%. The company’s earnings for the current quarter are projected to be $0.56 per share, reflecting an 18.8% decrease from the previous year, while the Zacks Consensus Estimate for the fiscal year stands at $3.97, indicating a year-over-year growth of 19.9%.

Advanced Micro is projected to generate $7.41 billion in revenue for the current quarter, representing a 27% year-over-year increase. For the next fiscal year, the revenue estimates are $31.78 billion and $37.05 billion, reflecting changes of +23.2% and +16.6%, respectively. The company reported revenues of $7.44 billion in its last quarter, a 35.9% year-over-year increase, surpassing the Zacks Consensus Estimate by 4.45%.

Currently, AMD holds a Zacks Rank #3 (Hold), suggesting it may perform in line with the broader market in the near term. Its valuation metrics indicate a grade of D on the Zacks Value Style Score system, suggesting the stock is trading at a premium to its peers.

“`