AMD’s Q1 Performance Boosts Stock Amid Trade Deal Speculations

Advanced Micro Devices’ AMD has seen a 5% increase in stock price following a strong Q1 earnings report released on Tuesday. The rise was further supported by President Trump’s announcement of a new trade deal with the United Kingdom, igniting investor interest.

Given Trump’s remarks about reinforcing chip manufacturing in the U.S., this raises the question of whether now is an opportune moment to invest in AMD for potential growth.

AMD’s Q1 Growth Highlights

During a challenging landscape influenced by tariffs and regulations, CEO Lisa Su emphasized AMD’s impressive start to the year, noting that growth has accelerated for the fourth consecutive quarter.

Buoyed by momentum in Data Center and AI sectors, AMD’s Q1 sales surged 36% to $7.43 billion, up from $5.47 billion the previous year. This figure exceeded expectations of $7.12 billion. Remarkably, AMD has exceeded top line estimates for ten consecutive quarters. Earnings per share (EPS) rose 55% to $0.96, compared to $0.62 in the same quarter last year, surpassing Zacks’ consensus estimate of $0.93. This achievement marks 25 consecutive quarters of meeting or exceeding earnings expectations.

Image Source: Zacks Investment Research

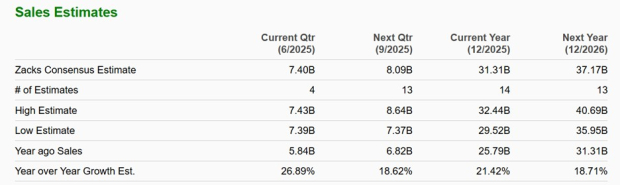

Revenue Outlook for Q2 and Beyond

For Q2, AMD anticipates revenue of approximately $7.4 billion, with a variance of plus or minus $300 million, projecting a growth rate of 27%. This forecast aligns with current Zacks consensus and accounts for an estimated $700 million revenue decline due to new export license requirements for its MI308 AI accelerator chips directed toward China, impacting their advanced MI300X chip.

For the entire fiscal year, AMD expects the revenue reduction caused by the export license to total around $1.5 billion. According to Zacks, AMD’s sales are forecasted to grow by 21% in fiscal 2025, reaching $31.31 billion compared to $25.79 billion last year. Moreover, FY26 sales are projected to increase by another 19% to $37.17 billion.

Image Source: Zacks Investment Research

AMD Stock Performance Overview

Despite the recent earnings-induced surge, AMD stock remains down 15% year-to-date, a more significant drop compared to overall market indexes and rival Nvidia’s decline of 12%. In the past three years, AMD has seen a modest increase of just 19%, lagging behind the broader market and Nvidia’s remarkable 600% gains.

Image Source: Zacks Investment Research

Conclusion

Although AMD ranks as the second-largest producer of AI GPUs behind Nvidia, enthusiasm for its growth trajectory has diminished recently. Currently, AMD holds a Zacks Rank #3 (Hold) following its positive Q1 report. The potential for further appreciation appears contingent on upcoming earnings estimate revisions as analysts assess the ramifications of tariffs and export license implications in the ongoing trade dispute with China.