Apple Faces 2025 Tariff Challenges but Eyes Recovery

Apple (NASDAQ: AAPL) has experienced a challenging 2025 in the Stock market as investors grapple with the potential impact of tariffs imposed by the Trump administration on imports from China, a key manufacturing location for the tech giant. The company has also been affected by reciprocal tariffs on other countries manufacturing its devices.

As of now, shares of the iPhone manufacturer have dropped by 20% this year. However, recent announcements indicate that Apple could see some relief as imports of smartphones, computers, and electronic components like processors and displays have been exempted from the tariffs related to China.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

This raises the question—should investors seize the opportunity to buy shares of Apple while prices are down? Let’s explore that possibility.

Impact of Tariffs on Apple’s Growth Potential

Initially, the Trump administration announced reciprocal tariffs of 125%, alongside existing 20% duties on Chinese imports. This drastic increase would have made Apple’s products, such as iPhones, significantly more expensive, leading to a drop in stock prices following the announcement.

Consequently, the pause on tariffs affecting smartphones and electronics from China is a relief for Apple. The company had recently shipped approximately 1.5 million iPhones from India to the U.S. to avoid tariff penalties before the announcement. Although a 26% tariff rate on imports from India was briefly imposed, it has now been paused for a period of 90 days.

The immediate outlook for Apple appears to brighten somewhat as it navigates these tariff-related challenges. According to analysis from Morgan Stanley, the company could have faced a negative impact of $7 billion to $8 billion on iPhone sales even with a larger shift of production to India, which benefits from lower tariff rates compared to China.

Currently, around 80% of Apple’s production capacity resides in China, with only 10% to 15% of iPhones assembled in India, as reported by Evercore ISI. Other production countries like Vietnam, Malaysia, and Thailand also contribute to Apple’s output, originally facing similar tariff implications. Apple has minimal mass production facilities in the U.S., which is a significant factor explaining the recent pressure on its stock.

The increased import duties could have inflated product prices, requiring Apple to pass those costs onto consumers, potentially hampering sales, particularly of the iPhone, which is still facing a challenging market environment.

Market research conducted by IDC shows that Apple’s iPhone shipments fell nearly 1% in 2024, totaling 232 million units. Apple has fallen behind competitors like Samsung and many Chinese manufacturers in incorporating artificial intelligence (AI) features into its smartphones. A price increase driven by tariffs could hinder iPhone sales further when the company is just beginning to see positive sales impacts from its gradual AI feature rollout.

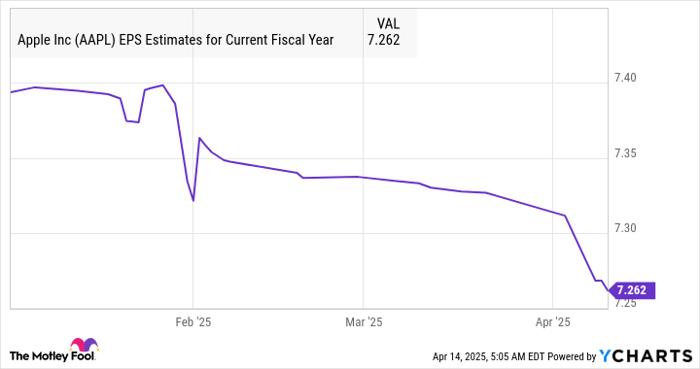

Moreover, if Apple couldn’t pass on the increased costs to consumers, its profit margins would take a hit, prompting analysts to revise downward their earnings expectations for the current fiscal year.

AAPL EPS Estimates for Current Fiscal Year data by YCharts

Strategies to Navigate Tariff Turbulence

Apple has ramped up production in India and undertaken efforts to ship products to the U.S. ahead of the anticipated tariff hike. This proactive approach may allow the company to enhance its production capabilities in regions expected to incur lower tariff rates.

In addition, Apple has rolled out a substantial $500 billion investment strategy aimed at strengthening its manufacturing operations in the U.S. over the next four years. However, this is a long-term plan, and transitioning complex supply chains back to the U.S. will take considerable time. Until a definitive resolution is reached regarding tariffs, Apple remains exposed to potential adverse impacts.

The future of this tariff scenario is uncertain, especially with indications that the administration may show flexibility. As such, the scrutiny of Apple’s financial performance will likely remain ongoing. If Apple can exceed earnings expectations or if outcomes related to the tariff conflict shift favorably, it may bounce back effectively.

Consensus projections indicate a 7% increase in Apple’s earnings for the current fiscal year, followed by an anticipated 11% growth in the subsequent year. Currently, the Stock trades at a multiple of 31 times earnings, which is higher than the tech-driven Nasdaq-100 index’s earnings multiple of 28, used as a benchmark for tech stocks.

In light of the prevailing mix of slow earnings growth, tariff uncertainties, and relatively elevated valuations, investors may want to exercise caution before jumping in. Observing Apple from the sidelines may be prudent for now, as a favorable shift in the tariff landscape or more attractive pricing could present a worthwhile investment opportunity, especially with the expansion of AI potentially serving as a significant growth driver in the future.

Is Investing $1,000 in Apple the Right Move Now?

Before making a purchase of Stock in Apple, consider the following:

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks for immediate investment, and Apple did not make the list. These recommendations have the potential to yield substantial returns in the coming years.

For instance, when Netflix was recommended on December 17, 2004, an investment of $1,000 would now be worth $518,599!* Similarly, an initial investment of $1,000 in Nvidia on April 15, 2005, would now amount to $640,429!*

It’s important to note Stock Advisor has achieved an average return of 794% — significantly outperforming 153% of the S&P 500. Join Stock Advisor to access the latest recommendations.

see the 10 stocks »

*Stock Advisor returns as of April 14, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.