The Latest Performance Trends

JPMorgan (JPM) stocks have dropped by about 7% since reaching their 52-week high at the end of August. Meanwhile, Wells Fargo (WFC) is down only half as much during the same period. Both banks will kick off the Q3 earnings season for the Finance sector on October 11th.

While the recent decrease in JPMorgan and Wells Fargo shares stands out, these stocks have been strong performers over the past year. The S&P 500 index has seen a modest gain of 0.8% compared to the decline in these bank stocks’ value.

Key Factors Influencing Bank Stocks

The recent underperformance of JPMorgan and Wells Fargo stocks can be attributed to concerns around economic growth and the impact of lower interest rates on their net interest incomes.

Loan demand has been sluggish, with the industry experiencing about 1% growth in Q3. However, an improving loan demand outlook is expected in the future if the economy avoids recession.

On the credit quality front, despite challenges in the commercial real estate market, major banks are adequately prepared. Recent bankruptcy trends in the U.S. have shown improvement, indicating healthier household balance sheets.

Anticipated Earnings and Revenues

JPMorgan is projected to report an earnings per share (EPS) of $4.04 (down 6.7% year-over-year) on $41.01 billion in revenues (up 2.9% YoY). Wells Fargo is expected to report an EPS of $1.27 (down 8.6% YoY) on $20.38 billion in revenues (down 2.3% YoY).

Overall Sector Outlook and Valuation

The Zacks Major Banks industry, including JPMorgan and Wells Fargo, is forecasted to have lower earnings in Q3 2024 but slightly higher revenues. The sector has contributed significantly to the Finance sector’s total earnings over the past year.

Despite the past year’s strong performance, bank stocks remain attractively valued. Compared to historical data, the industry’s valuation multiples are still favorable for potential investors.

Considerations and Market Comparison

Given the Finance sector’s discounted valuation compared to the S&P 500 index, it presents an appealing investment opportunity. Investors who believe in a soft landing for the economy may find this sector particularly promising.

Insights on Corporate Earnings

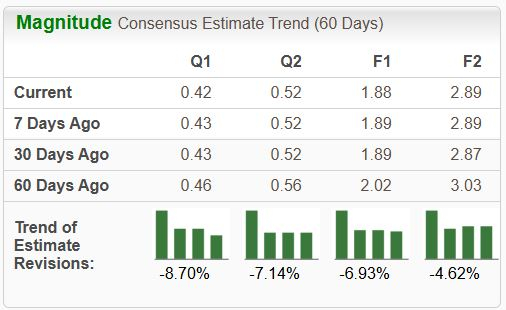

Overall, Q3 earnings for the S&P 500 index are expected to rise 3.3% from a year earlier, with revenues increasing by 4.5%. While earnings growth has been positive, recent revisions have shown a slight downturn in expectations.

The Road Ahead: Q3 Earnings Expectations and Insights

Significant Shifts in Q3 Estimates

Recent months have witnessed substantial downward revisions in Q3 earnings growth expectations, affecting various sectors. While Transportation, Energy, Business Services, and Aerospace suffered declines, the Tech and Finance sectors experienced modest upticks.

Positive Outlook Amidst Revisions

Despite these revisions, accelerating growth is anticipated in the forthcoming periods, with an expected all-time high in quarterly earnings. This optimism is supported by a chart demonstrating the anticipated earnings trend.

Long-Term Growth Projection

The overall earnings landscape points to a 7.8% growth in 2021, followed by double-digit increases in 2025 and 2026.

Early Q3 Earnings Insights

The Q3 season has kicked off with promising results from 21 S&P 500 members, showing a 20.3% earnings increase and 2.7% higher revenues. The historic context of these growth rates is illustrated in the comparison charts below.

Anticipating Trends

While it’s early to draw conclusions, the favorable revenue beat percentage in the initial stage of Q3 reporting sets an encouraging tone for the upcoming period.

Insider Insights on Potential Stock Gains

Discover the stocks predicted to potentially double in value soon. Director of Research, Sheraz Mian, highlights an innovative financial firm poised for significant gains, building on past Zacks’ success stories.

Explore in-depth insights on earnings trends and future expectations in our complimentary Earnings Trends report.

To view the original article at Zacks.com, click here.

Image Source: Zacks Investment Research