Broadcom Anticipates Strong Q2 Fiscal 2025 Earnings Report

Broadcom (AVGO) will announce its second-quarter fiscal 2025 results on June 5. The company forecasts revenues of $14.9 billion, slightly below the Zacks Consensus Estimate of $14.92 billion, which indicates a 19.5% increase from the previous year.

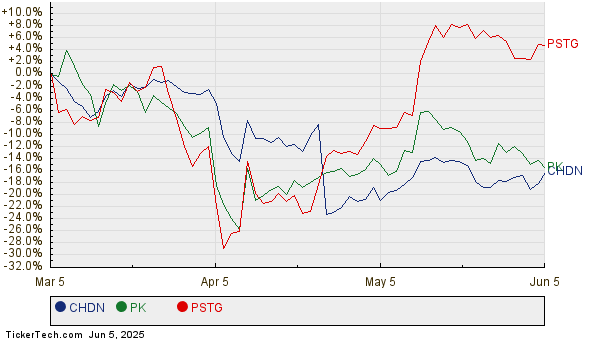

The earnings estimate remains at $1.57 per share, reflecting a 42.73% growth compared to last year’s figures. AVGO has consistently exceeded the Zacks Consensus Estimate in the past four quarters, with an average earnings surprise of 3.44%.

Broadcom Inc. Price and EPS Surprise

Broadcom Inc. price-earnings surprise | Broadcom Inc. Quote

Key Drivers for Broadcom’s Upcoming Q2 Earnings

Broadcom’s fiscal Q2 results are expected to benefit from its growing AI segment, projected to increase by 44% year-over-year to $4.1 billion. Investments in AI data centers by hyperscaler partners are anticipated to enhance performance.

The company expects semiconductor revenue to rise 2% sequentially and 17% year-over-year, reaching $8.4 billion, while Infrastructure Software revenue is anticipated to grow 23% year-over-year to $6.5 billion. VMware’s annual booking value is projected to exceed $3 billion.

The Zacks Consensus Estimate for Semiconductor Solutions revenue stands at $8.42 billion, suggesting 17% year-over-year growth, while Infrastructure Software revenue is estimated at $6.51 billion, reflecting a 23.1% increase.

Strong performance at VMware is expected to drive top-line growth, with 60% of the transition to a subscription model completed by the end of Q1 fiscal 2025. Additionally, VMware Private AI Foundation’s adoption is growing, supported by a collaboration with NVIDIA (NVDA).

Broadcom anticipates an adjusted EBITDA margin of 66% for the upcoming quarter.

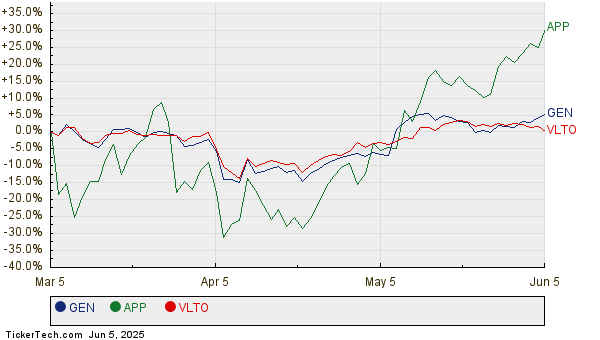

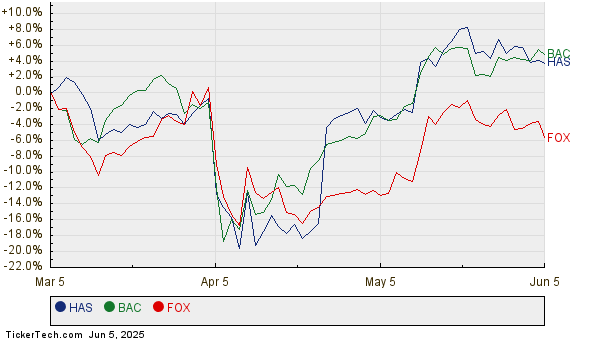

AVGO Stock Performance Compared to Sector

AVGO shares have returned 7.3% year-to-date, surpassing the broader Zacks Computer and Technology sector’s decline of 1.1% and the Zacks Electronics – Semiconductors industry’s increase of 1.1%.

AVGO Stock Performance

Image Source: Zacks Investment Research

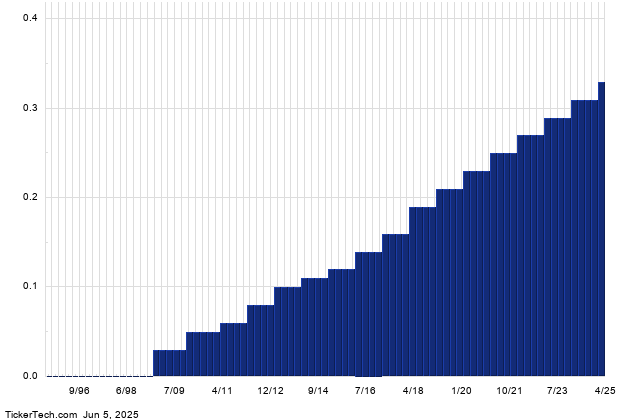

The AVGO stock has a Value Score of D, indicating a potential overvaluation. Currently, shares trade at a forward 12-month price/sales ratio of 17.13 compared to a median of 13.72, while the sector stands at 6.36.

P/S Ratio (F12M)

Image Source: Zacks Investment Research

Broadcom’s Long-Term Outlook and AI Focus

Broadcom’s long-term outlook is favorable due to rising demand for AI infrastructure and a solid partner network including Alphabet (GOOGL) and Meta Platforms (META). Its application-specific integrated circuits (ASICs) are gaining traction among major clients.

The acquisition of VMware has enhanced its infrastructure software solutions, with significant uptake of VMware Cloud Foundation by its largest customers. Broadcom acknowledges potential in the AI sector, projecting substantial growth in serviceable markets by fiscal 2027.

Furthermore, Broadcom aims to reduce its debt, having paid off $1.1 billion in the first quarter of fiscal 2025, while maintaining strong cash flow to support dividend payouts.

Conclusion

Broadcom’s robust portfolio and expanding partnerships suggest strong long-term growth potential, justifying its current valuation. The company holds a Zacks Rank #2 (Buy), indicating a favorable investment opportunity ahead of the Q2 results.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.