“`html

Enphase Energy (ENPH) has experienced a significant drop of -27.3% in share price over the past month, in contrast to the Zacks S&P 500 composite decline of -1.2% and the Zacks Solar industry loss of -2.8%.

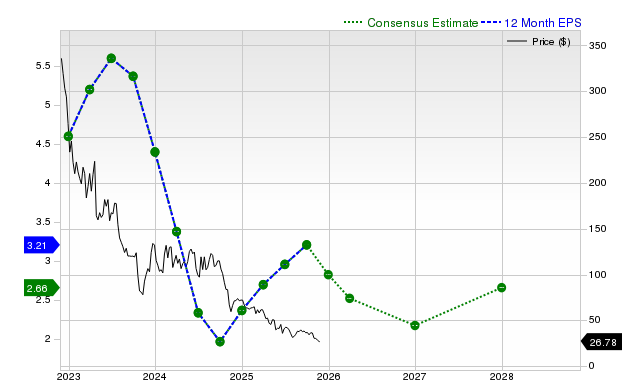

For the current fiscal quarter, Enphase is expected to report earnings of $0.56 per share, reflecting a -40.4% year-over-year decrease, with a consensus estimate revision of -34.4% over the last 30 days. Revenue estimates for the quarter stand at $331.97 million, anticipated to decline by -13.3% year-over-year. The company reported revenues of $410.43 million in the last quarter, exceeding the consensus estimate by 13.44%.

Currently, Enphase holds a Zacks Rank #3 (Hold), indicating it may perform in line with the broader market in the near future. Estimates for the fiscal year project earnings of $2.79 (up 17.7% from last year) and for the next fiscal year, earnings are expected at $2.18 (down -21.9% year-over-year).

“`