Fortinet’s Stock Surge: Is It Time to Buy?

Fortinet (NASDAQ: FTNT) has seen strong performance in the stock market over the last six months, with shares climbing by an impressive 55%. This surge follows positive quarterly reports, indicating robust growth for the cybersecurity company.

Strong Fourth-Quarter Results Boost Investor Confidence

The company received a further boost from its fourth-quarter 2024 results released on February 6. Following the announcement, Fortinet’s stock rose nearly 3% as revenue and earnings significantly surpassed analyst expectations. The optimistic guidance for 2025 added to this positive sentiment, as it also exceeded consensus estimates.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Examining Fortinet’s High Valuation

With the recent surge, Fortinet’s price-to-earnings ratio has reached 48, which is high compared to the Nasdaq-100 index’s multiple of 34. The forward earnings multiple of 45 also indicates that analysts do not expect significant bottom-line growth this year.

Analysts predict a modest 5% increase in earnings for Fortinet this year, projecting earnings of $2.48 per share—just above the top end of the company’s guidance. This anticipated growth is considerably slower than last year’s remarkable 45% increase. The company benefited from three acquisitions last year, which improved its billing and likely bolstered profits.

Last year, Fortinet aimed for earnings between $1.65 and $1.70 per share. The substantial earnings growth was also supported by reduced inventory write-downs, leading to heightened gross margins. However, investors should note that many factors contributing to last year’s growth may not be present in 2025, resulting in slower earnings growth.

Future Potential Amidst Current Concerns

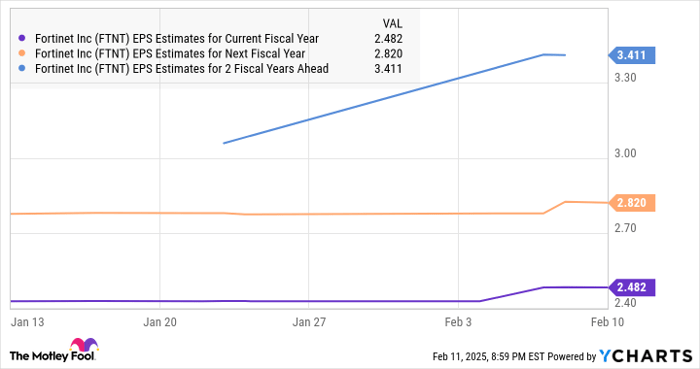

Investors may be wary of the high valuation and anticipated slower earnings growth. Yet, a recent chart suggests that analysts foresee an acceleration in Fortinet’s earnings growth over the coming years.

FTNT EPS Estimates for Current Fiscal Year data by YCharts

This optimistic outlook is backed by Fortinet’s strong position as a market leader in network firewall security, with a market share exceeding 50%. This leadership places Fortinet in a prime position to benefit from a network firewall market projected to grow nearly two-and-a-half times by 2034.

Moreover, Fortinet is finding success in the rapidly expanding unified secure access service edge (SASE) market, which integrates networking and security into a single platform. This market is estimated to grow at 12% annually until 2029, potentially generating $17 billion in yearly revenue. Notably, Fortinet’s remaining performance obligations (RPO) in unified SASE rose 21% year over year in the fourth quarter, indicating healthy contract signings.

This suggests that Fortinet is likely to capture a sizable share of this market in the future, justifying analysts’ expectations of improved earnings growth. If Fortinet achieves earnings of $3.41 per share by 2027 and trades at 44 times earnings, its stock price might rise to $150—a potential increase of 39% from current levels.

Seize the Opportunity for Potential Growth

If you’ve ever felt you missed your chance to invest in successful companies, consider this advice.

Occasionally, expert analysts issue a “Double Down” stock recommendation for companies expected to rise significantly. Now could be a prime time to buy before prices escalate. Here’s a look at past performance:

- Nvidia: A $1,000 investment in 2009 would be worth $360,040!*

- Apple: A $1,000 investment in 2008 would be worth $46,374!*

- Netflix: A $1,000 investment in 2004 would be worth $570,894!*

Currently, “Double Down” alerts are being issued for three remarkable companies, and this might be one of the last chances to invest strategically.

Learn more »

*Stock Advisor returns as of February 3, 2025

Harsh Chauhan has no position in any of the mentioned stocks. The Motley Fool recommends Fortinet and has positions in it. The Motley Fool operates with a disclosure policy.

The views expressed here belong solely to the author and do not represent Nasdaq, Inc.