“`html

Decoding Wall Street’s Take on IonQ: A Cautious Investment Approach

Investors frequently look to Wall Street analysts when deciding whether to Buy, Sell, or Hold a stock. Although changes in stock ratings can influence prices, it’s important to assess their actual value.

Let’s examine the current outlook from analysts on IonQ, Inc. (IONQ) and consider how brokerage recommendations may impact your investment choices.

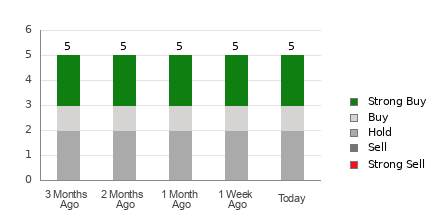

IonQ sports an average brokerage recommendation (ABR) of 2.00, graded on a scale from 1 to 5 (Strong Buy to Strong Sell). This rating reflects the consensus from five different brokerage firms, with an ABR of 2.00 suggesting a Buy stance.

Within those five recommendations, there are two classified as Strong Buy and one as Buy. These Strong Buy and Buy ratings represent 40% and 20% of the total recommendations respectively.

Analyzing the Recommendations for IONQ

Explore the price target and stock forecast for IonQ here>>>

The average brokerage recommendation indicates a potential buying opportunity for IonQ; however, relying solely on this information might not be wise. Research has shown that brokerage recommendations frequently mislead investors regarding stocks likely to rise in value.

But why might that be? Brokerage firms often possess vested interests in the stocks they cover, leading their analysts to exhibit bias in their recommendations. Studies demonstrate that for each “Strong Sell,” there are typically five “Strong Buy” ratings.

This means their recommendations may not align with the true direction of a stock’s price. Thus, using this information as a validation tool for your own research could enhance your investment strategy.

Zacks Rank, a proprietary rating tool with a strong track record, scores stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This system effectively predicts a stock’s performance in the near term and can complement the average brokerage recommendation to inform your investment decisions.

Distinguishing Zacks Rank from ABR

Although Zacks Rank and ABR both use a 1 to 5 system, they represent different metrics.

The ABR is based solely on brokerage recommendations, often shown as a decimal (such as 1.28). Conversely, the Zacks Rank is a quantitative tool rooted in earnings estimate changes and is expressed in whole numbers (1 to 5).

Broker analysts have historically tended to be overly optimistic. Their favorable ratings aren’t always backed by analytical research and can mislead investors. The Zacks Rank, however, relies on the actual shifts in earnings estimates, which have shown a strong link to short-term stock price movements based on extensive research.

Additionally, Zacks Rank is proportionately distributed across all stocks with earnings estimates provided by analysts. This ensures a balanced rating distribution among the five ranks.

Another noteworthy distinction lies in the freshness of these ratings. The ABR may lack real-time updates, while the Zacks Rank reflects immediate changes in earnings estimates, making it a more timely predictor of future stock prices.

Should You Consider Investing in IONQ?

Currently, the Zacks Consensus Estimate for IonQ’s earnings has held steady at -$0.84 for this year.

This stable consensus indicates that analysts share a consistent outlook on the company’s earnings trajectory, which may suggest that the stock will perform similarly to the broader market in the near future.

The combination of the unchanged consensus estimate along with other earnings-related factors has earned IonQ a Zacks Rank #3 (Hold). You can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

With this information, being cautious about the Buy rating for IonQ is advisable.

Industry Leader’s Top Stock Pick

From thousands of potential investments, five Zacks experts have each selected one stock expected to increase by 100% or more in the coming months. Among these, Director of Research Sheraz Mian identifies one stock he believes has the most significant potential for growth.

This company is focused on millennial and Gen Z consumers and generated nearly $1 billion in revenue last quarter. A recent price drop makes this an advantageous time to invest. While not all of Zacks’ selections succeed, this one has the potential to outperform past Zacks stocks like Nano-X Imaging, which surged by 129.6% in just over nine months.

Discover Our Top Stock and Four Runners-Up

IonQ, Inc. (IONQ): Access Your Free Stock Analysis Report.

Read the complete article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`