Lam Research Posts Strong Q3 Results, Insights on Future Growth

Lam Research Corporation (LRCX) recently reported robust results for the third quarter of fiscal 2025, leading to a 7% increase in its stock price since April 23. As a prominent player in semiconductor fabrication equipment, Lam Research exceeded financial expectations and reaffirmed its critical role in the industry amidst ongoing fluctuations in the semiconductor cycle.

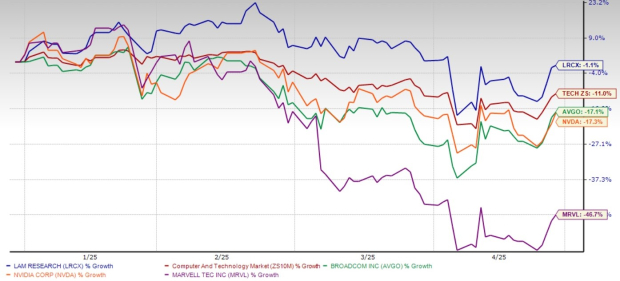

Despite a 1.1% year-to-date (YTD) decline in a highly volatile market, Lam Research shows positive momentum following its earnings report. This stability highlights the company’s attractive valuation compared to peers. In the YTD period, LRCX has performed well against major competitors, including Broadcom (AVGO), NVIDIA (NVDA), and Marvell Technology (MRVL), as well as the Zacks Computer and Technology sector.

YTD Price Return Performance

Image Source: Zacks Investment Research

Q3 Results Highlight Financial Resilience

In the third quarter, Lam Research’s earnings surpassed market expectations, presenting a solid financial foundation. Total revenues reached $4.72 billion, reflecting a 24.5% year-over-year increase, driven by robust demand in memory and logic sectors. Despite challenges facing the semiconductor industry, the company achieved a non-GAAP EPS of $1.04, exceeding analyst forecasts and indicating a 33.5% improvement from the previous year (adjusted for the stock split).

Lam Research Price, Consensus, and EPS Surprise

This strong performance underscores Lam Research’s ability to navigate an evolving semiconductor landscape. As the demand for advanced nodes rises, LRCX’s technology in etch and deposition tools positions it well to benefit from this trend. Furthermore, the company’s strategic cost management supports its sustained profitability amid varying end-market demands.

Datacenter and AI Chip Demand Fueling Growth

The growing demand for AI and datacenter chips is significantly benefiting Lam Research. The company’s deposition and etch solutions are vital for producing high-bandwidth memory (HBM) and advanced packaging technologies, which are essential for AI applications.

In 2024, Lam Research shipped over $1 billion in gate-all-around nodes and advanced packaging. Management anticipates this figure will triple to more than $3 billion by 2025. Furthermore, trends in backside power distribution and dry-resist processing offer new growth avenues for Lam’s innovative fabrication solutions.

With investments in AI accelerating, Lam’s leadership in etch and deposition positions it to capitalize on the next semiconductor spending cycle.

Strategic Investments Supporting Future Prospects

Investments in research and development are yielding positive results for Lam Research. The company’s Cryo 3.0 technology is establishing new performance benchmarks in high-aspect-ratio dielectric etch applications, enhancing its competitive edge in advanced semiconductor manufacturing.

Additionally, Lam’s Aether dry-resist solution has been adopted by key customers, including a major memory manufacturer for high-bandwidth DRAM production. This solidifies Lam Research’s growing influence in the memory fabrication market, in light of the soaring demand for HBM driven by AI and high-performance computing (HPC).

Strategically, the company has expanded its manufacturing capabilities in Asia, enhancing cost efficiencies and responsiveness. These actions resulted in a 160-basis point improvement in operating margins in 2024, despite broader industry headwinds. In the third quarter of fiscal 2025, non-GAAP operating margin rose 210 basis points year over year to 32.8%.

NAND Market Recovery Driving Growth

Lam Research is poised to benefit from the recovery of the NAND flash market. After enduring a prolonged downturn, NAND spending is showing early signs of resurgence.

While industry-wide NAND investments remain focused on technology upgrades rather than capacity expansion, Lam Research’s molybdenum and carbon gap fill solutions are gaining traction. Management estimates these technologies will generate hundreds of millions of dollars in NAND-related revenues in 2025.

The transition to higher-layer count technology (above 200-layer counts) among NAND manufacturers further supports Lam Research’s revenue growth trajectory in the forthcoming years.

Valuation: An Attractive Opportunity

Currently, Lam Research’s stock is trading at a forward price-to-earnings (P/E) ratio of 18.1, notably below the sector average of 23.43. This valuation reflects the company’s long-term growth potential.

Image Source: Zacks Investment Research

Presently, LRCX’s P/E ratio is lower than that of major semiconductor companies such as Broadcom, NVIDIA, and Marvell Technology, which stand at 26.68, 24.71, and 20.03, respectively.

Conclusion: A Buy Recommendation for LRCX

Given its favorable valuation, strong financial performance, and strategic focus on AI-driven opportunities, Lam Research appears to be a compelling investment. The company is gaining market share in AI and datacenter fabrication, bolstered by innovative product launches.

Currently, LRCX holds a Zacks Rank #2 (Buy), indicating a positive outlook for investors.