Unveiling Wall Street’s Perspective

Investors frequently rely on the guidance of Wall Street analysts when deliberating on stock investments. The team here at Wall Street casts a significant shadow that mold investors’ decisions. Regarding Lantheus Holdings (LNTH), it’s important to delve into the brokerage recommendations before we delve into their trustworthiness and actionable potential.

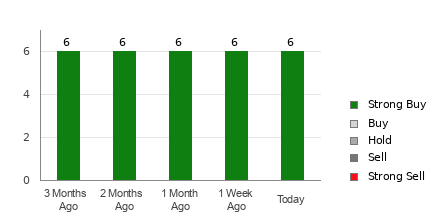

Brokerage Recommendations for LNTH

Lantheus Holdings currently boasts an average brokerage recommendation (ABR) of 1.22, hovering between Strong Buy and Buy, as deduced from the endorsements offered by nine brokerage firms. Remarkably, the overwhelming majority of the recommendations, a whopping 88.9%, stand at Strong Buy.

Scrutinizing Wall Street Analysts’ Recommendations

Should one base investment decisions solely on the ABR? Interestingly, numerous studies point to the lack of efficacy in using brokerage recommendations as a reliable compass for identifying stocks with robust price appreciation potential.

Fascinatingly, brokerage analysts’ favorable bias, underpinned by their employers’ vested interests in the stocks they cover, skews their ratings towards a strong positive disposition. This optimistic slant is evidenced as brokerage firms typically assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

The Zacks Rank vs ABR

While both the Zacks Rank and ABR are bound by a 1 to 5 scale, they are distinct measures. The ABR revolves solely around brokerage recommendations and is typically presented with decimals. On the other hand, the Zacks Rank is propelled by earnings estimate revisions, depicted in whole numbers ranging from 1 to 5.

Brokerage analysts’ perpetual penchant for overly-positive recommendations contrasts sharply with the Zacks Rank, which is rooted in earnings estimate revisions, proving to be a more reliable guiding light for investors.

Evaluating Lantheus Holdings’ Prospects

Relating to Lantheus Holdings, the Zacks Consensus Estimate for the current year has witnessed a 0.5% upturn over the past month, now standing at $5.98. This uptick underscores analysts’ burgeoning optimism regarding the company’s earnings prospects, translating into a Zacks Rank #2 (Buy) for Lantheus Holdings.

Thus, while the ABR suggests a buying position for Lantheus Holdings, combining it with the Zacks Rank could equip investors with a compelling toolkit for profitable decision-making.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.