“`html

Lucid Group (NASDAQ: LCID) has seen its stock price plummet from a peak of $55.52 in November 2021 to about $3 a share as of October 2024. The luxury electric vehicle maker, which went public via a SPAC merger in July 2021, has consistently missed its production targets, delivering only 4,369 vehicles in 2022, 6,001 in 2023, and 10,241 projected for 2024, far below previously stated goals of 20,000, 49,000, and 90,000 vehicles respectively for those years.

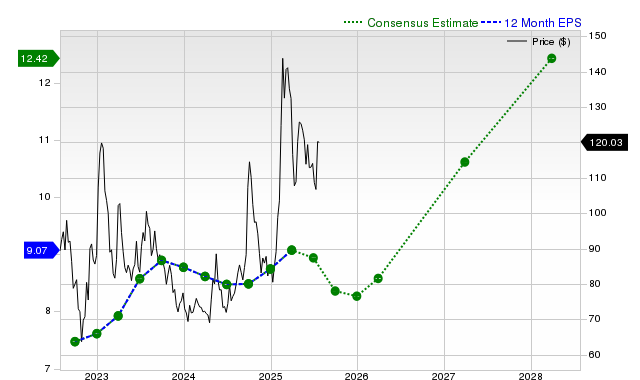

By the end of Q3 2024, Lucid reported $5.16 billion in liquidity and has plans to ramp up production, especially with the anticipated Gravity model set to launch in late 2024. Despite a significant stake held by the Saudi Arabian government, which has committed to purchasing 100,000 vehicles over the next decade, analysts predict annual losses between $2 billion and $3 billion for the next several years, even as revenues are expected to rise from $786 million in 2024 to $2.88 billion by 2026.

As of now, Lucid’s stock trades at 5 times its projected 2025 sales, making it look attractive compared to Tesla’s 11 times; however, profitability remains a concern given Lucid’s ongoing financial struggles and high share dilution since its debut.

“`