Meta and Microsoft Surge After Strong Quarterly Earnings Reports

The Nasdaq index is on the rise, buoyed by positive quarterly results and forecasts from Meta Platforms META and Microsoft MSFT.

Reporting after market hours on Thursday, both companies exceeded expectations, with Meta’s stock climbing +4% and Microsoft’s rising +7% in today’s trading session.

Meta’s Q1 Results

Meta’s CEO Mark Zuckerberg emphasized progress in its AI initiatives. In the first quarter, the company’s sales increased 16% year over year to $42.31 billion, surpassing estimates of $41.23 billion. Notably, Meta AI users reached nearly one billion monthly active users (MAU), while Daily Active People (DAP) on Facebook and Instagram grew by 6% to 3.43 billion.

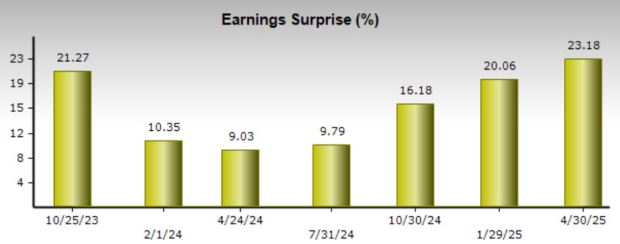

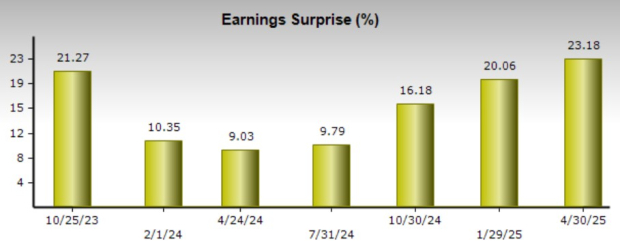

On earnings, Meta’s Q1 EPS jumped 36% to $6.43, up from $4.71 a year prior. This result exceeded Q1 earnings expectations of $5.22 per share by 23%, marking ten consecutive quarters of surpassing the Zacks EPS Consensus.

Image Source: Zacks Investment Research

Microsoft’s Q3 Results

Microsoft’s fiscal third-quarter results were particularly well-received, focusing on the company’s role in technology-driven applications, including cloud and AI. Cloud revenue surged 20% to $42.4 billion, driven by AI solutions. The Intelligence Cloud segment, which includes Azure, contributed $26.75 billion to this total, with Azure sales growing 21%, aided by 16 percentage points from its AI initiatives.

Overall, Microsoft’s Q3 sales rose 13% to $70.06 billion, surpassing estimates of $68.38 billion. Furthermore, net income increased 18% to $3.46 per share, compared to EPS of $2.94 in the previous quarter. Microsoft has now exceeded earnings expectations for 11 consecutive quarters.

Image Source: Zacks Investment Research

Revenue Guidance for Meta and Microsoft

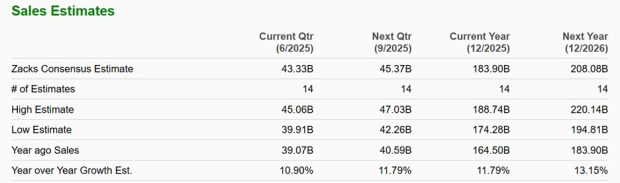

Meta anticipates Q2 revenue between $42.5 billion and $45.5 billion, aligning closely with Zacks’ estimate of $43.33 billion, reflecting an 11% growth. For fiscal 2025, analysts predict a 12% increase in total sales, with a further 13% rise anticipated in FY26, reaching $208.08 billion.

Image Source: Zacks Investment Research

In Microsoft’s case, it projects Q4 revenue between $73.15 billion and $74.25 billion, above the Zacks Consensus of $72.03 billion, reflecting 11% growth. Furthermore, Azure is expected to grow by 34%-35% in Q4, with annual sales growth anticipated to exceed 12% in FY25 and FY26, with total sales surpassing $300 billion.

Image Source: Zacks Investment Research

Evaluating P/E Valuations for Meta and Microsoft

Both Meta and Microsoft are poised for long-term investment potential. Meta’s forward P/E ratio stands at 22.7, making it the second cheapest amongst the “Mag 7” tech stocks, trailing only Alphabet GOOGL.

Conversely, Microsoft’s forward P/E is 30.3, which is not far from the S&P 500’s average of 21.4. Notably, this is a 20% discount compared to its historical high of 38.2.

Image Source: Zacks Investment Research

Conclusion

There is potential for further positive movement in Meta and Microsoft’s stocks following their encouraging quarterly performance and outlook. Currently, both companies hold a Zacks Rank #3 (Hold), though upgrades may be forthcoming as earnings estimates are likely to rise in the near future.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.