Meta and Microsoft Prepare to Report Q1 Earnings Amid Market Challenges

Meta Platforms META and Microsoft MSFT will start a key week of quarterly earnings reports from major technology companies. Their results are set to be released after market hours on Wednesday, April 30.

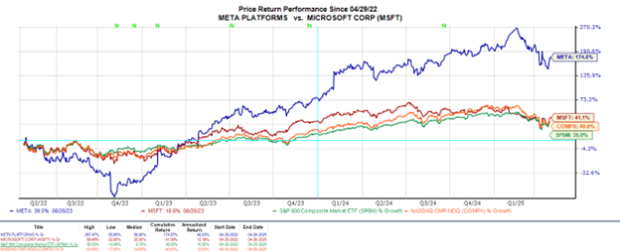

Both companies are crucial to potential market recovery, as their stocks have each declined over 6% in 2025. However, Meta’s stock has increased by 174% and Microsoft’s by 41% over the last three years, outperforming the broader market.

Image Source: Zacks Investment Research

Meta Platforms Q1 Expectations

Meta is expected to report a 13% increase in Q1 sales, reaching $41.22 billion, compared to $36.46 billion one year ago. Investors will be looking for insights on how U.S.-China trade tensions impact advertising spending from major clients like Temu and Shein, two prominent advertisers on Facebook and Instagram.

Analysts predict Meta’s Q1 earnings per share (EPS) will increase by 10% to $5.21 from $4.71 in the same quarter last year. The company has surpassed the Zacks EPS Consensus for nine consecutive quarters, achieving an average earnings surprise of 13.77% over the last four reports.

Image Source: Zacks Investment Research

Microsoft’s Q3 Expectations

For its fiscal third quarter, Microsoft is projected to report a 10% increase in sales, reaching $68.38 billion, up from $61.86 billion year-over-year. The company faces challenges from increased tariffs on technology equipment and recently suspended a $1 billion data center project in Ohio due to these issues.

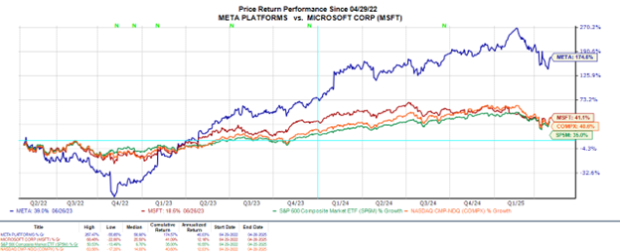

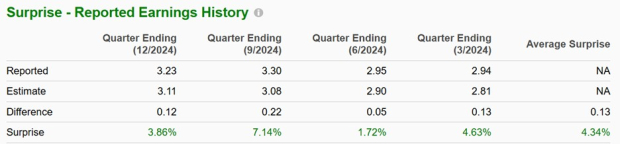

Microsoft’s Q3 EPS is expected to rise by 9% to $3.20, compared to $2.94 in the prior year period. The company has met or exceeded earnings expectations for 10 consecutive quarters, with an average EPS surprise of 4.34% recently.

Image Source: Zacks Investment Research

Outlook for Meta & Microsoft

According to Zacks estimates, Meta’s total sales are forecasted to grow by 12% in fiscal 2025, with another expected rise of 13% in FY26, bringing total revenue to $208.4 billion. Annual earnings are projected to increase by 1% this year and spike by 13% in FY26, potentially reaching $27.38 per share.

Image Source: Zacks Investment Research

Microsoft’s revenue is also expected to expand over 12% in FY25 and FY26, surpassing the $300 billion mark. Its annual earnings estimates project a 10% increase in FY25, followed by a 13% rise in FY26, bringing earnings per share to $14.60.

Image Source: Zacks Investment Research

Conclusion

Currently, both Meta Platforms and Microsoft have a Zacks Rank #3 (Hold). Their upcoming quarterly results and any guidance provided will be essential to confirming their growth trajectories amid potential complications from higher tariffs.