Netflix’s Impressive Rebound: Could It Continue in 2025?

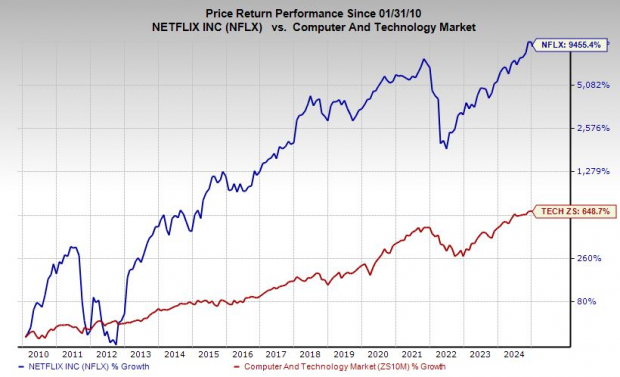

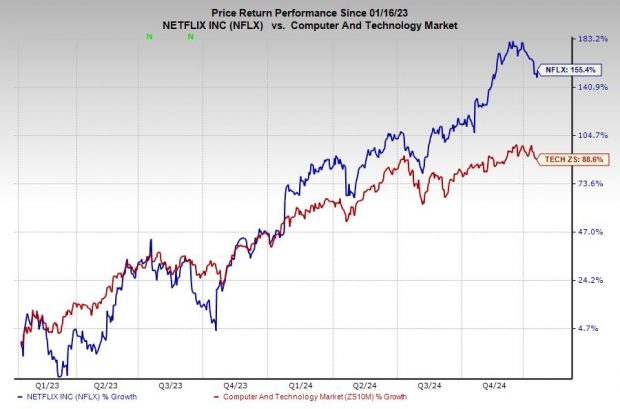

The streaming leader Netflix (NFLX) has surged 400% since its 2022 lows and a remarkable 75% in the past year, significantly outperforming tech sector stocks that have grown only 30% during the same period.

Despite these gains, Netflix’s stock did not surpass its 2021 records until the fourth quarter of 2024. In contrast to the tech sector’s stagnant performance, Netflix’s share price has risen 30% in the last six months.

The financial community is recognizing Netflix’s success in expanding its user base, increasing subscription prices, generating profits, introducing an ad-supported tier, and gradually moving into live sports and entertainment.

However, NFLX saw a 10% decline from its December highs as it approached its earnings report on January 21.

Is this a good buying opportunity for tech investors, or is Netflix facing a larger decline?

Why Investors Are Bullish on Netflix for 2025 and Beyond

Netflix has dramatically changed the landscape of entertainment. Its early entry into streaming, combined with aggressive investments in original content, has positioned it as a leader among rivals like Disney (DIS), Apple, and Amazon.

Taking note of investor feedback, Netflix has transformed its business over the past few years to enhance growth and earnings.

One of its major strategies has been to clamp down on excessive account sharing. Additionally, the company launched a lower-cost, ad-supported subscription option in late 2022. Two years later, Netflix reported that this ad-based tier attracted 70 million users globally.

Image Source: Zacks Investment Research

In November, Netflix revealed that over half of its new subscriptions in available countries were for the ad-supported plan. In the first three quarters of 2024, NFLX added 22.5 million subscribers, achieving an average Year-over-Year growth of 16%, totaling 282.72 million users. This growth followed the company’s best quarter since the pandemic.

Netflix differentiates itself through pricing, with its $6.99 ad-supported plan appealingly lower than Disney’s $9.99 ad option and significantly less than bundles including Hulu and MAX.

In comparison, Disney’s recent report indicated around 157 million global monthly active users watching ad-supported content across Disney+, Hulu, and ESPN+, which is 125 million fewer than Netflix.

Netflix’s foray into live sports, reality shows, blockbuster films, and more has contributed to its subscriber retention and growth.

Image Source: Zacks Investment Research

According to Nielsen, over 24 million viewers in the U.S. watched each of Netflix’s two Christmas Day games. The company has also seen success in launching reality shows and is exploring video games.

The Rise of Netflix Stock: Key Drivers

In the third quarter, Netflix achieved a record-high operating margin of 30% and boosted its operating profit by 52% year-over-year to $2.9 billion. NFLX’s earnings increased by 45% last quarter alongside 15% higher revenue.

Looking ahead, revenue for 2024 is expected to grow by 15%, followed by over 12% growth in 2025, bringing it to $43.71 billion—an increase of $10 billion compared to 2023. This growth comes amid 7% sales expansion in both 2022 and 2023.

Adjusted earnings per share are projected to rise 64% in 2024 and 19% in FY25, reaching $23.52—nearly double the amount for FY23—after a 21% growth last year.

Although Netflix has recently seen stagnation in its EPS revisions, resulting in a Zacks Rank #3 (Hold), the overall earnings outlook for FY24, FY25, and FY26 has improved significantly over the past year. This rebound in earnings is a key factor in the stock’s sharp recovery from 2022 lows.

Image Source: Zacks Investment Research

Over the past decade, Netflix shares have increased by 1,660%, outpacing the tech sector by fivefold (and 51,000% in the past 20 years). In the last five years alone, NFLX has gained 151%, compared to the tech sector’s 121%. This includes a 75% increase in the last year against tech’s 30% rise.

Finally, Netflix broke significantly above its 2021 highs, achieving new records in early Q4. However, after reaching these heights, the stock experienced a 10% dip from its December peaks amid overbuying conditions.

Image Source: Zacks Investment Research

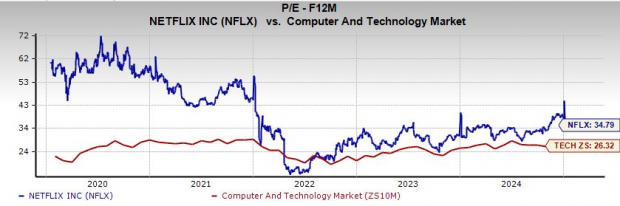

When it comes to valuation, Netflix currently trades at over a 90% discount from its 10-year highs and 50% lower than its five-year average.

Netflix’s Earnings: What Investors Can Expect

Netflix’s Stock Valuation Amid Industry Changes

Currently, Netflix (NFLX) trades at a forward earnings valuation of 34.8X, aligning with its 10-year median. The company’s price/earnings-to-growth (PEG) ratio stands at 1.3, indicating a 25% discount compared to the broader tech industry, despite Netflix outperforming its tech peers. In contrast, Disney’s PEG ratio reflects a 32% premium, even though Disney’s stock has only risen 14% over the past decade.

Upcoming Changes in Netflix’s Subscriber Reporting

Starting with the first quarter of 2025, Netflix will cease reporting subscriber numbers. This decision follows Netflix’s earlier move to eliminate subscriber guidance. The company indicated that subscriber figures have become less relevant due to its varied pricing plans.

Image Source: Zacks Investment Research

Moving forward, Netflix will highlight “major subscriber milestones” along with focusing on earnings, margins, and other significant financial metrics.

Currently, NFLX appears to be finding support near crucial levels observed in November. If it holds steady, there is potential for the stock to retake its 50-day moving average and possibly reach new all-time highs if the upcoming earnings impress investors.

Speculation also surrounds a potential stock split for Netflix in the near future.

Zacks Identifies Top Semiconductor Stock

In a related note, Zacks Investment Research has identified a new semiconductor stock they consider a top choice for investors. While it’s significantly smaller than NVIDIA, which has surged over 800% since Zacks recommended it, this new stock is expected to benefit from the growing demand in Artificial Intelligence and related technologies.

With a robust growth in earnings and a larger customer base, this company is well-poised to capitalize on expanding global semiconductor manufacturing, projected to rise from $452 billion in 2021 to $803 billion by 2028.

Want more insights from Zacks Investment Research? You can download their report on the “7 Best Stocks for the Next 30 Days” for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.