Oracle’s Quiet Rise: Capitalizing on the AI Boom

While not as flashy as some mega-cap tech peers, Oracle (NYSE: ORCL) has seen substantial gains thanks to the growing demand for its AI technology. Over the past year, the company’s share price has soared by 53%.

The cloud computing titan has a lot to offer, but can this upward trend continue? Let’s explore if Oracle stock is a buy today.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Strong Demand for AI Cloud Solutions

As companies ramp up their AI capabilities, Oracle’s suite of products has grown increasingly vital. Their offerings include hybrid cloud solutions such as infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS), essential for tasks like data storage and AI model training.

Recent trends reflect solid growth. In Oracle’s fiscal 2025 second quarter, which ended on November 30, 2024, total revenue rose by 9% compared to the same period a year prior. Adjusted earnings per share (EPS) increased by 10%. Particularly impressive was the 52% boost in cloud infrastructure revenue, attributed to unprecedented AI demand and a rise in new customers.

Another significant financial indicator is Oracle’s remaining performance obligation (RPO), which hit an all-time high of $97 billion—up 49% from last year. This metric gauges contracts not yet recognized as revenue, suggesting promising future growth. For the upcoming year, management anticipates double-digit revenue growth, potentially accelerating into fiscal 2026.

Shifts towards high-tech services are expected to enhance margins and earnings. Analyst projections from Yahoo! Finance indicate Oracle’s EPS will outpace revenue growth, forecasting a 10.6% increase this year and a 14.1% rise next year.

| Metric | 2025 Estimate | 2026 Estimate |

|---|---|---|

| Revenue | $57.7 billion | $65.0 billion |

| Revenue growth (YOY) | 9% | 12.6% |

| Adjusted EPS | $6.15 | $7.02 |

| Adjusted EPS growth (YOY) | 10.6% | 14.1% |

Data source: Yahoo! Finance. YOY = year over year.

The Stargate Initiative: A Catalyst for Growth

A pivotal development for Oracle this year is its involvement in the Stargate Initiative. Announced by the Biden administration, this AI infrastructure project aims to secure the U.S.’s lead in high-tech innovation, emphasizing its critical role in national security.

With an initial investment of $100 billion from Japanese holding group SoftBank, the initiative includes Oracle and OpenAI, focusing on building data centers to support advanced AI models. Oracle is poised to gain significantly as a key tech provider. OpenAI plans to shift its AI workloads to Oracle Cloud Infrastructure, which is expected to drive growth in the coming years.

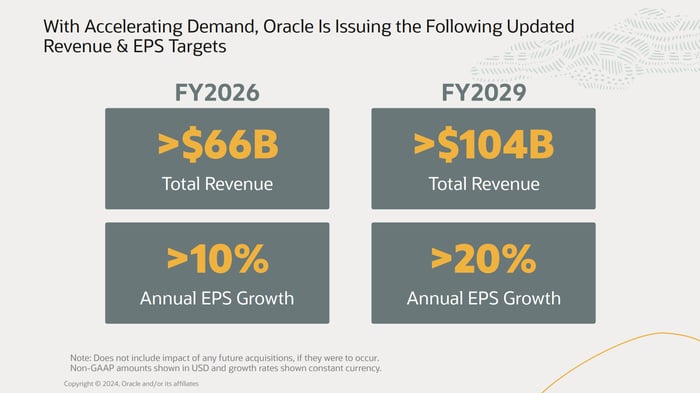

The Stargate Initiative could help Oracle reaffirm its ambitious financial targets. The company estimates it will exceed $104 billion in revenue by fiscal 2029, nearly doubling its $53 billion revenue from fiscal 2024. Additionally, it expects EPS growth to surpass 20% annually over the next five years.

Source: Oracle.

Oracle Stock’s Positive Outlook

Oracle’s strong position in the tech landscape, particularly in cybersecurity and data privacy, makes it an intriguing investment. Its flagship Autonomous Database platform leverages AI and machine learning to improve productivity, showcasing its broad exposure to technological advancements.

The stock is currently trading at a forward price-to-earnings ratio of 25 times its projected 2026 EPS, potentially presenting a valuable investment opportunity if growth expectations materialize.

In conclusion, Oracle is well positioned to continue rewarding shareholders as it pursues its growth strategy, justifying its inclusion in diversified portfolios for 2025.

A Potentially Profitable Investment Opportunity

Have you ever thought you missed out on investing in top-performing stocks? Now may be your chance.

Our analysts occasionally issue a “Double Down” stock recommendation for companies expected to rise significantly. If you’re concerned about missing your opportunity, now is the time to consider investing. The records are impressive:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $360,040!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,374!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $570,894!*

We are currently issuing “Double Down” alerts for three remarkable companies, and this may be a unique opportunity.

Learn more »

*Stock Advisor returns as of February 3, 2025

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.