Palantir Technologies Surges After Strong Q4 Earnings Report

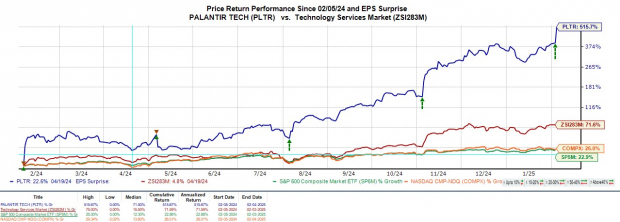

On Wednesday, Palantir Technologies PLTR saw its stock price rise over 20% following impressive Q4 results announced last night.

The surge in interest surrounds Palantir’s artificial intelligence platform (AIP), which has led the stock to exceed $100, marking an increase of 500% over the past year.

Image Source: Zacks Investment Research

Impressive Q4 Performance

Palantir specializes in software that aids counterterrorism investigations, yet its AIP is now attracting traditional businesses as well.

In Q4, sales soared 36% year-over-year, reaching $827.52 million, compared to $608.35 million during the same period last year. Analysts had predicted sales of around $777.49 million, meaning Palantir exceeded expectations comfortably.

Operational highlights included generating $460 million in cash from operations and $517 million in adjusted free cash flow, translating to margins of 56% and 63%, respectively. The earnings per share (EPS) for Q4 was $0.14, surpassing the forecast of $0.11 and up from $0.08 a year earlier. Notably, Palantir has now met or exceeded EPS consensus for nine consecutive quarters, with an average surprise of 12.72% over the last four quarters.

Image Source: Zacks Investment Research

Full-Year Highlights

For the full fiscal year 2024, Palantir’s sales increased by 29% to $2.87 billion, up from $2.22 billion in 2023. Furthermore, the company reported annual earnings of $0.41 per share, compared to $0.08 the previous year.

Total cash from operations reached $1.15 billion, with adjusted free cash flow at $1.25 billion, reflecting margins of 40% and 44%, respectively.

Optimistic Revenue Projections

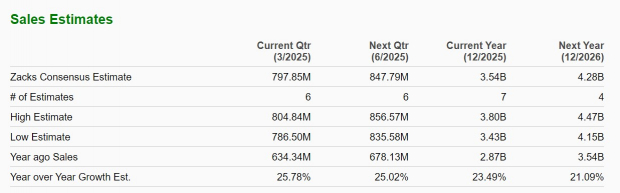

Looking ahead to Q1 of FY25, Palantir anticipates revenue between $858 million and $862 million, significantly above the current Zacks Consensus estimate of $797.85 million, representing a growth of 26%. For FY25, the company expects total sales to range from $3.741 billion to $3.757 billion, also exceeding the consensus forecast of $3.54 billion, which represents a 23% growth target.

Image Source: Zacks Investment Research

Final Thoughts

The significant increase in Palantir Technologies stock may continue due to its strong Q4 report and promising forecasts. Holding a Zacks Rank #2 (Buy), it is likely that earnings estimates will be revised upward in the near future. Additionally, the company’s balance sheet is strengthening as its cash reserves grow.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts have selected their favorites to potentially skyrocket +100% or more in the coming months. Among these, Director of Research Sheraz Mian has singled out one as having the most extraordinary upside.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter. A recent pullback in its stock makes now a favorable time to invest. Although not every elite pick succeeds, this one could surpass prior Zacks’ Stocks Set to Double, similar to Nano-X Imaging, which increased by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.