“`html

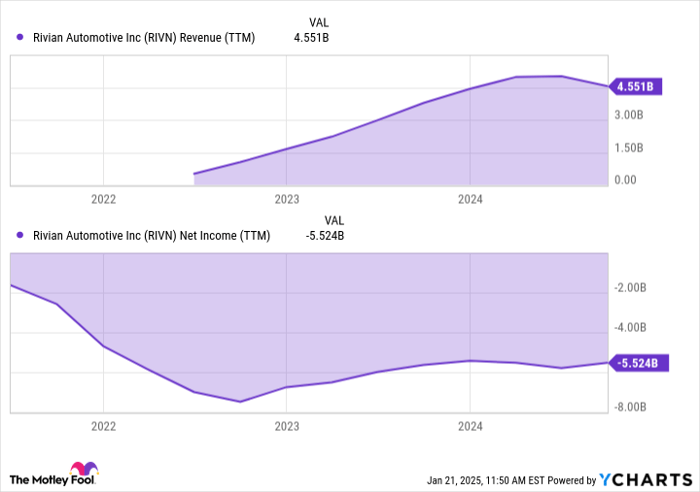

Rivian Automotive (NASDAQ: RIVN), a U.S.-based electric vehicle (EV) maker, generated $3.2 billion in revenue in the first nine months of 2024, but incurred a gross profit loss of $1.3 billion and an operating loss of $4 billion. The company produces vehicles at its Normal, Illinois facility and has revised its 2024 production forecast to 48,000 vehicles due to component shortages.

In the fourth quarter, Rivian produced 12,727 vehicles and delivered 14,183. Management anticipates a positive gross profit for Q4, driven by $275 million in contracted regulatory credit revenues. The company plans to expand production through a $6.6 billion loan agreement with the U.S. Department of Energy, aiming to construct a new manufacturing facility in Georgia by 2026.

Amidst various challenges, Rivian continues to innovate its product lineup, with deliveries of its new R2 model expected to start in 2026. The company needs to achieve profitability while navigating potential changes to federal EV policies under incoming President Donald Trump.

“`