SoundHound AI Stock Jumped 1,000% Amid AI Surge

Artificial intelligence (AI) stocks have gained significant attention over the past two years. SoundHound AI (NASDAQ: SOUN), which specializes in voice AI, experienced a dramatic increase in share price. From 2023 to 2024, SoundHound surged 1,000%, surpassing Nvidia, which rose by 800% during the same timeframe.

Earlier this year, concerns regarding economic growth and AI spending impacted stock performance. President Trump proposed tariffs on imports, raising fears of increased product costs and potential economic downturn. Consequently, investors withdrew from high-growth companies likely to be affected first.

As a result, AI stocks, including SoundHound’s, have seen declines, with the company losing around 50% since the year’s start. Despite this, SoundHound reported a 151% revenue increase last quarter. Additionally, optimism from Trump’s initial tariff agreement with China has contributed to a market rebound.

SoundHound’s Unique Advantage

SoundHound distinguishes itself in the voice AI field due to its innovative technology. Unlike most systems that convert speech to text and then to meaning, SoundHound translates speech directly into meaning. This method enhances both speed and accuracy. The company holds over 200 patents, providing a competitive edge.

This innovation has allowed SoundHound to grow its market presence across multiple sectors, including restaurants, healthcare, and finance. Recently, the company expanded its contract with a major U.S. pizza chain and renewed relationships with three healthcare clients.

SoundHound’s revenue for the last quarter approached $30 million, indicating substantial growth potential. The company’s customer diversification is notable, as individual clients contributed 10% or less to total revenue.

Prospects in Agentic AI

SoundHound is advancing in agentic AI, which applies AI to solve real-world issues. The launch of its Amelia 7.0 platform allows clients to execute various tasks, such as handling prescription refills and scheduling appointments. The company also boasts a cash position of $246 million and no debt, positioning itself well for future growth amid an AI market expected to exceed $2 trillion by 2030.

Valuation Concerns

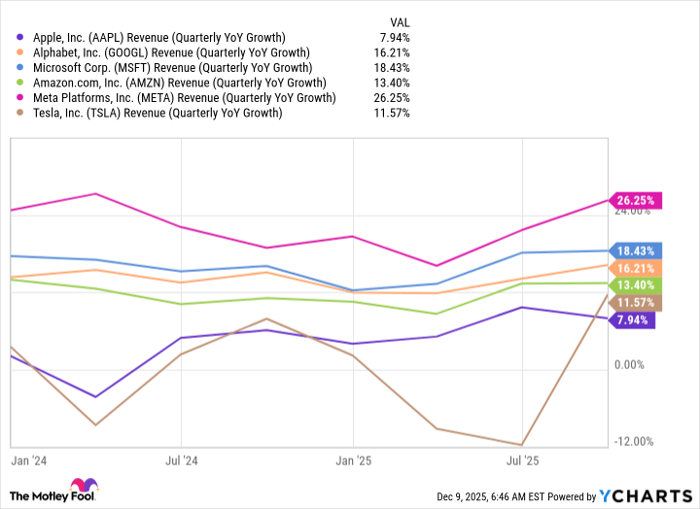

Despite its potential, SoundHound’s stock remains high-priced, trading at 38 times sales. Value-oriented investors might find better opportunities elsewhere. Given the current market uncertainty, many may prefer larger, more established AI companies like Nvidia.

Consequently, SoundHound’s appeal depends on individual risk tolerance and investment style. It may not suit value investors or those seeking stability. However, patient growth investors could find worth in buying SoundHound during this dip.

Investment Considerations

Before considering SoundHound AI stock, note that analysts recently identified ten stocks they believe are currently better buys, excluding SoundHound. Historical data indicates that some of these stocks have significantly outperformed the market.

Investors should weigh their options carefully before proceeding.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.