SoundHound AI: Analysts Mixed on Future Stock Performance

Determining whether to buy, sell, or hold a stock is a key task for investors, often guided by the recommendations of analysts. These opinions, often reported widely in the media, can impact a stock’s price. But how valuable are these ratings really?

Before diving into the reliability of these analyses, let’s take a closer look at what analysts are saying about SoundHound AI, Inc. (SOUN).

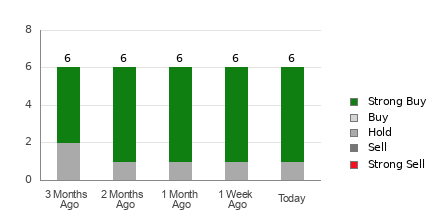

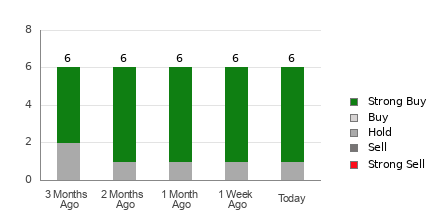

Currently, SoundHound AI boasts an average brokerage recommendation (ABR) of 1.33, on a scale of 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. This figure is derived from the assessments made by six brokerage firms and indicates a recommendation between Strong Buy and Buy.

Among the recommendations, five firms suggest Strong Buy, making up 83.3% of the total recommendations.

Brokerage Rating Trends for SOUN

Explore price targets & forecasts for SoundHound AI here>>>

The current ABR suggests a buying opportunity for SoundHound AI, but relying solely on this information for investment decisions can be risky. Studies indicate that brokerage recommendations are not always effective in helping investors choose the stocks that will see significant price increases.

The reason behind this is the potential bias that brokerage firms may have toward the stocks they cover. Research shows that for every “Strong Sell” recommendation, there are about five “Strong Buy” ratings. This dynamic implies that the interests of brokerage firms might not align with those of individual investors, leading to recommendations that don’t always accurately reflect future price movements. Therefore, it is wise to use these recommendations to corroborate your own research or utilize reliable tools for stock analysis.

Zacks Rank, a proprietary tool with a strong historical track record, rates stocks on a similar scale from 1 to 5, with Rank #1 being Strong Buy and Rank #5 being Strong Sell. This method focuses primarily on earnings estimate revisions and can be a strong predictor of a stock’s pricing in the short term. Pairing the ABR with the Zacks Rank could enhance your investment strategy.

Understanding the Differences: ABR vs. Zacks Rank

Despite both being rated on a scale from 1 to 5, ABR and Zacks Rank measure different aspects. ABR is derived solely from analyst recommendations and often features decimal values, such as 1.28. In contrast, the Zacks Rank is based on a quantitative model that leverages revisions to earnings estimates and is displayed as whole numbers.

Brokerage analysts are frequently overly optimistic in their evaluations. Thus, the ratings from these analysts often mislead investors because of the conflicting interests of their firms. Conversely, Zacks Rank focuses on the trends in earnings estimate revisions, which empirical research has shown correlates strongly with near-term stock price changes.

Another important distinction lies in the timeliness of these ratings. While the ABR may not always reflect the latest data, the Zacks Rank updates quickly according to changes in earnings estimates, ensuring it remains relevant.

Should SOUN Be on Your Radar?

As for earnings estimates for SoundHound AI, the Zacks Consensus Estimate for this year has stayed steady at -$0.36 over the past month.

The lack of change in analysts’ earnings outlook suggests that the stock may keep pace with the overall market in the near term.

The combination of the recent stability in consensus estimates, along with several other earnings-related factors, has earned SoundHound AI a Zacks Rank of #3 (Hold). Interested investors can browse today’s top Zacks Rank #1 (Strong Buy) stocks here>>>

With that in mind, caution might be warranted regarding the current Buy-equivalent ABR for SoundHound AI.

Zacks Identifies Top Semiconductor Stock

This stock is a mere 1/9,000th the size of NVIDIA, which has increased by over 800% since our recommendation. While NVIDIA remains strong, our new leading chip stock has substantial growth potential.

With impressive earnings growth and an expanding clientele, it’s well-positioned to benefit from the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Forecasts suggest that global semiconductor manufacturing could grow from $452 billion in 2021 to $803 billion by 2028.

Discover this stock for free >>

Access a Free Stock Analysis Report for SoundHound AI, Inc. (SOUN)

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.