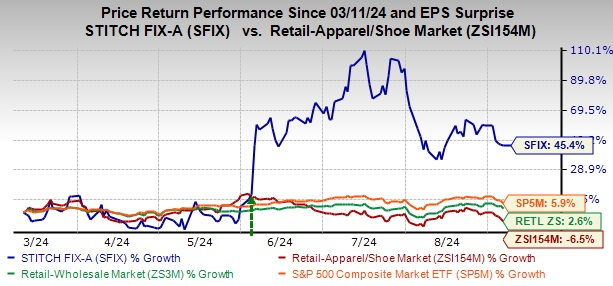

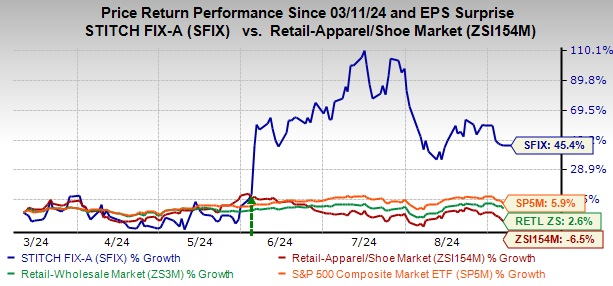

Stitch Fix, Inc.SFIX has stunned the financial world with a 45.4% climb in its stock price over the last half-year, eclipsing the Zacks Retail-Apparel and Shoes sector’s 6.5% nosedive. This meteoric rise is fueled by the company’s strategic maneuvers, such as the implementation of AI-driven inventory management, optimized pricing strategies, enhanced client interactions, and streamlined cost structures.

At the current mark of $3.46 as of Sept. 6, SFIX seems to be eyeing its 52-week zenith of $5.05 achieved on July 16, 2024, leaving investors contemplating whether they have hit the jackpot or if there are more winning cards up Stitch Fix’s sleeve.

Trading above both its 100-day and 200-day moving averages, SFIX’s stock signals a bullish trend with a stable price trajectory. This technical fortitude underscores the market’s confidence in Stitch Fix’s financial strength and growth potential.

With a forward 12-month price-to-sales ratio of 0.33, lower than its historical median of 0.54 and the industry average of 1.04, SFIX currently presents an enticing opportunity for investors seeking exposure in the retail sector. An ‘A’ on the Value Score further cements its allure in the market.

Image Source: Zacks Investment Research

The Tailored Path of Stitch Fix’s Growth

Stitch Fix’s ascent is powered by its adept utilization of AI and data analytics, which have been intricately woven into the company’s operations. Noteworthy is the introduction of an AI-based inventory buying tool, orchestrating nearly half of all inventory decisions and significantly enhancing operational efficiency when juxtaposed with conventional methods.

The rollout of Quick Fixes, allowing clients to schedule an additional fix right after checkout, has led to a remarkable 25% surge in average order value in a span of three weeks, underscoring the company’s agility in meeting customer demands.

Strategic pricing architecture revisions are forecasted to generate over $20 million in yearly contribution profit, fine-tuning prices to mirror the value proposition and drive profitability.

Margin expansion and operational streamlining are key focal points, with the third quarter of fiscal 2024 spotlighting a 280-basis-point boost in gross margin, scaling to 45.5%. This elevation is underpinned by robust product margins and enhanced transportation efficiencies, mirroring Stitch Fix’s commitment to optimal pricing and inventory management.

Client-centric enhancements include elevated interactions, expanded item offerings per fix, revamped discount approaches, and smoother onboarding processes. These efforts have yielded higher average order values and enhanced retention metrics, reflecting contented clientele and brand loyalty.

The launch of Stitch Fix Freestyle has revolutionized shopping experiences, enabling customers to explore and purchase curated items based on their style, sans the prerequisite of a Fix first. This initiative dovetails with the strategy to widen the consumer base and realize sustained profitability.

From a marketing standpoint, a pivot towards prioritizing liquidity preservation and profitability, coupled with operational restructurings like consolidating U.S. warehouse hubs and divesting the U.K. operations, positions SFIX for enduring growth.

Challenges on the Horizon: SFIX’s Shrinking Client Base

Amidst the triumphs, a downward trajectory in active clients over the past eight quarters emerges as a notable hurdle, driving a revenue downturn. In the third quarter of fiscal 2024, active clients participating in ongoing operations plummeted by 20% year-over-year to 2,633,000.

This client exodus contributed to a 15.8% revenue dip in the same quarter, underscoring persistent challenges in client retention and acquisition, potentially hinting at deeper issues related to product attractiveness amid a competitive market landscape.

A Tapestry of Potential: Is Stitch Fix a Sound Investment?

Despite the dwindling client base, SFIX’s rebound narrative, propelled by innovative AI-driven strategies, presents a compelling case for investors seeking a blend of efficiency, profitability, and client engagement.

Trading at a discount compared to historical and industry standards, supported by strong technical indicators, Stitch Fix showcases resilience and growth potential. The company’s focus on operational effectiveness and financial robustness further solidifies its investment appeal. Stitch Fix currently holds a Zacks Rank #3 (Hold).

Emerging Stronger: Stock Picks for the Savvy Investor

For investors seeking alternative plays, notable stocks include Boot Barn Holdings, Inc. (BOOT), Abercrombie & Fitch Co. (ANF), and Steven Madden, Ltd. (SHOO).

Boot Barn, a lifestyle retail chain specializing in western and work-related attire, stands tall with a Zacks Rank #1 (Strong Buy).

Abercrombie & Fitch, renowned for premium casual wear, mirrors Boot Barn’s Zacks Rank of 1. ANF delivered a remarkable 16.8% earnings beat in the last quarter.

Steven Madden, a name synonymous with fashion-forward footwear, boasts a Zacks Rank of 2 (Buy). SHOO is backed by an impressive earnings trend, underscoring growth potential.

As you navigate the market landscape, these stocks offer a canvas of opportunities, each weaving a unique narrative of potential and value.

To uncover more insights, visit the original article on Zacks.com.

© 2024 Benzinga.com. Invest wisely. All rights reserved.