Tesla Stock Faces Market Volatility Amid Ongoing Investor Concerns

Tesla TSLA continues to experience significant market pressure, with shares down 35% year-to-date. Currently valued at $262, TSLA still boasts gains exceeding 40% over the last two years, aligning closely with the S&P 500’s performance but falling behind the Nasdaq’s robust 57% increase.

Despite a plunge from nearly $500 per share in December, many investors believe it’s premature to write off Tesla’s potential for a rebound.

Concerns about slowing electric vehicle (EV) growth and price reductions across Tesla’s product range have largely diminished, thanks in part to the company’s strong market position. This raises the question of whether now is an ideal time to invest in Tesla, especially as TSLA is currently trading 89% above its 52-week low of $138 from last April.

Image Source: Zacks Investment Research

Tesla and Investor Sentiment

Investor sentiment plays a crucial role in highlighting Tesla’s growth potential and explains its premium valuation compared to the broader market. Much of this sentiment can be attributed to CEO Elon Musk, whose leadership is both applauded and criticized.

Recently, Musk’s alignment with former President Trump has come under scrutiny, particularly as Tesla has retraced many of its post-election gains. His role in Trump’s Department of Government Efficiency (DOGE) raises questions about potential conflicts of interest and the implications for Tesla’s brand.

This context has caused TSLA to fall more sharply compared to other large tech companies, amid worries that Trump’s tariff policies could adversely impact the global economy. Conversely, some investors see Musk’s DOGE position as potentially favorable, suggesting it may lower regulatory burdens for Tesla and other EV manufacturers.

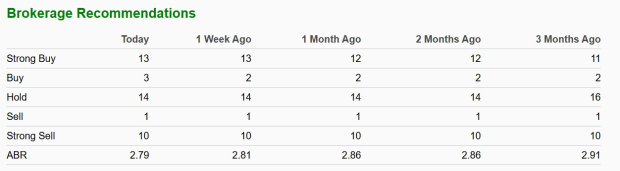

Average Broker Recommendations

A total of 41 brokerage firms currently cover Tesla Stock, providing insights to Zacks. TSLA holds an average broker recommendation (ABR) of 2.79 on a scale from 1 (Strong Buy) to 5 (Strong Sell). The diversity in opinions is evident: 13 brokers recommend a strong buy, 14 have a hold rating, while 10 suggest a strong sell.

Image Source: Zacks Investment Research

Assessing Tesla’s P/E Valuation

Tesla’s strong growth trajectory continues to attract investor interest, particularly amidst the current dip in TSLA shares. The stock trades significantly below its prior high of 240X forward earnings over the past three years, although it remains slightly above the median valuation of 84.1X during this same timeframe.

Image Source: Zacks Investment Research

Conclusion

While it might be premature to act on expectations of double-digit growth for Tesla in fiscal years 2025 and 2026, the company remains a solid long-term investment option. Currently, Tesla’s stock has a Zacks Rank of #3 (Hold). Moreover, the Average Zacks Price Target of $348.61 indicates a potential upside of 32% for TSLA. However, achieving this target will largely depend on the stabilization and overall recovery of broader markets.

Latest Release: Zacks Top 10 Stocks for 2025

Don’t miss the chance to invest early in our top 10 stock picks for 2025, curated by Zacks Director of Research, Sheraz Mian. This portfolio has shown impressive and consistent performance, gaining over 2,112.6% since inception in 2012, significantly outperforming the S&P 500’s +475.6%. Sheraz has meticulously selected the best 10 companies to invest in for 2025. Be among the first to see this newly released list with outstanding potential.

Check out the New Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days. Click to get access to this free report.

Tesla, Inc. (TSLA) : Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.