Tesla’s Upcoming Q1 Earnings: Market Insights and Challenges Ahead

Tesla (NASDAQ: TSLA) is approaching a crucial date. The electric vehicle (EV), energy storage, robotics, and artificial intelligence company is set to release its first-quarter 2025 earnings report after market hours on April 22. This quarterly event is a significant opportunity for investors to gauge the company’s performance and market standing.

This earnings release may be among Tesla’s most consequential in recent years, as it will provide insight into how CEO Elon Musk’s political engagements might have influenced the brand’s reputation and performance.

Where should you invest $1,000 today? Our analyst team has just revealed their top 10 stock picks you may want to consider. Continue »

Additionally, investors are keenly awaiting news about the company’s anticipated Robotaxi service, expected to launch in just a few months.

Q1 Delivery Numbers Disappoint: Analyzing Possible Factors

Tesla, despite its aspirations in robotics and self-driving technology, remains heavily reliant on EV sales as a primary revenue source. Recently, the company reported deliveries of 336,681 vehicles for the first quarter, falling short of market expectations, which ranged from 360,000 to 370,000. This figure marks a 13% decrease compared to last year.

Elon Musk’s remarks regarding these delivery numbers will likely be a focal point during the earnings call. His foray into U.S. politics, particularly through initiatives aimed at reducing government spending, has generated mixed reactions among consumers and investors.

The political climate has proven divisive, leading to incidents of protests and vandalism against Tesla vehicles and dealerships. Preliminary studies suggest that the brand has suffered in regions such as Europe and Canada.

Economic conditions also play a role. As consumer sentiment has dipped and auto loan delinquencies have surged in the U.S., potential buyers face increasing financial pressure, which may deter new vehicle purchases.

While political factors seem to have impacted Tesla’s sales, the weak delivery figures cannot entirely be attributed to these issues alone.

Tesla Stock Experiences Significant Decline

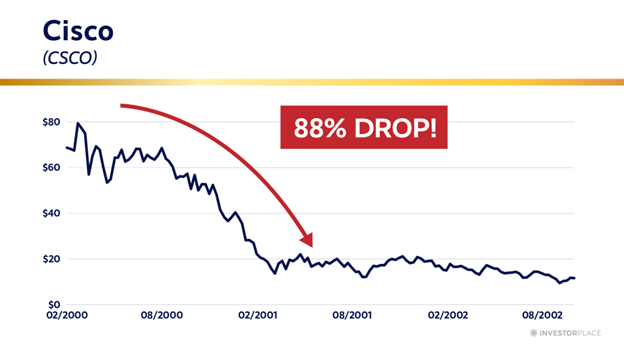

Negative publicity and heightened market fluctuations often have adverse effects on stock prices. Following the 2024 elections, Tesla’s stock reached a peak but has since plummeted nearly 50% over recent months.

This downturn may offer opportunities for long-term investors. While significant price drops can be alarming, I had previously highlighted concerns regarding Tesla’s valuation compared to its automotive peers.

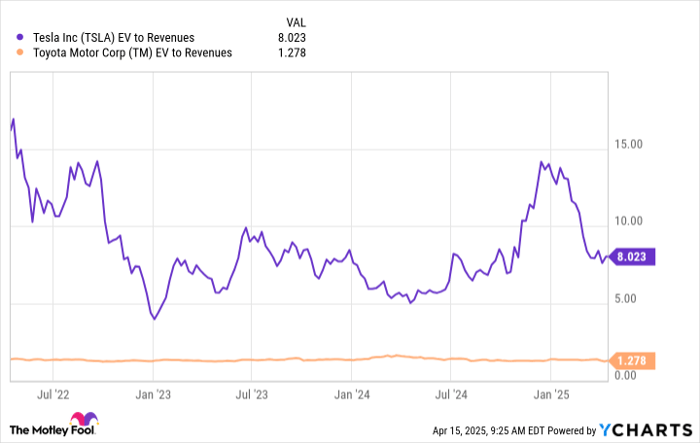

Notably, Tesla continues to focus primarily on automobile production, making it challenging to justify its stock losing value relative to traditional automakers like Toyota Motor:

TSLA EV-to-Revenue data by YCharts; EV = enterprise value.

Admittedly, it is reasonable for Tesla to command a higher valuation than conventional automakers, given its innovative prospects with the upcoming Robotaxi and Optimus robots. However, these products are not yet available in the market. Thus, a lower valuation could better position investors for positive outcomes as these developments unfold.

The good news is that Tesla’s enterprise value currently sits at a single-digit revenue multiple. Unfortunately, the likelihood of further declines exists, especially since the EV sector appears to be weakening for this quarter.

During the fourth-quarter earnings call, Musk mentioned that Tesla is undergoing a transitional phase as it escalates production of the new Model Y, prepares to launch a more affordable model, and readies for both Robotaxi and Optimus robot ventures.

Strategizing Ahead of Tesla’s Q1 Earnings on April 22

With ongoing disturbances surrounding Tesla’s internal and external circumstances, uncertainty remains high for this already contentious company and its stock.

For long-term investors, steep declines can present ideal buying opportunities. However, patience may be prudent as this situation continues to evolve.

The company’s core business appears to face challenges, and the limited launch of the Robotaxi service later this year is unlikely to reverse these issues. The stock currently seems overvalued, which increases the risk of further declines if market conditions remain turbulent.

Investors may wish to hold off for now. Monitoring Tesla’s first-quarter earnings report and Musk’s comments on the earnings call will be important before making any decisions. After reviewing the findings, investors should contemplate a gradual acquisition of shares if they believe in the company’s future direction. Taking a systematic approach is wise.

Don’t Miss Your Chance at a Potentially Profitable Investment

Ever feel like you’ve overlooked great investment opportunities? If so, you’ll want to pay attention.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies they forecast will rise significantly. If you think you’ve missed your window to invest, this is the moment to act before it’s too late, supported by compelling returns:

- Nvidia: A $1,000 investment made when we doubled down in 2009 would now be worth $263,189!*

- Apple: If you invested $1,000 when we doubled down in 2008, your investment would now stand at $37,346!*

- Netflix: A $1,000 investment recommended in 2004 would have grown to $524,747!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, available to those who join Stock Advisor, and opportunities like this may not arise again soon.

*Stock Advisor returns as of April 14, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.