CoreWeave Targets IPO as AI Market Gains Momentum

The initial public offering (IPO) market has faced significant challenges since 2021. From 2020 to 2021, numerous companies took the plunge into public markets, largely propelled by a surge in special purpose acquisition companies (SPACs). However, many of these businesses exhibited poor management or were involved in fraudulent activities. As a result, the current landscape shows only a trickle of new Stock listings, with many start-ups opting to stay private.

Could artificial intelligence (AI) be revitalizing the IPO market? Recently, AI cloud start-up CoreWeave filed its official financial statements in preparation for an IPO and Stock listing. This initiative might mark the debut of the first generative AI Stock on public markets. The company has the backing of Nvidia (NASDAQ: NVDA) and is expected to be closely monitored.

Exploring CoreWeave’s Business Model

Once a cryptocurrency mining operation, CoreWeave pivoted its business model due to dramatic changes in the crypto landscape. The cryptocurrency mining process demands extensive computing power, prompting the company to acquire a substantial number of graphics processing units (GPUs) from Nvidia. As cryptocurrency markets fell in late 2022, generative AI products gained popularity, exemplified by Chat GPT. This trend inspired CoreWeave to transition from crypto mining to become an AI cloud provider utilizing its Nvidia GPUs. Notably, Nvidia invested $100 million in CoreWeave in 2023.

Generative AI tools necessitate significant computing power for training and operation. Consequently, large technology firms are preparing to spend hundreds of billions on capital expenditures by 2025. The demand for cloud computing resources continues to grow, leaving customers eager to invest in hyperscalers like CoreWeave.

Positioned as an AI-focused cloud hyperscaler, CoreWeave is competing with giants such as Amazon Web Services, Microsoft Azure, and Alphabet‘s Google Cloud. This focused strategy appears effective; the company’s revenue jumped from $15.8 million in 2022 to an impressive $1.9 billion in 2024, marking it as one of the fastest-growing businesses worldwide. Additionally, CoreWeave reported $324 million in operating income last year, just a few years post-pivot.

Financial Considerations and Risks Ahead

CoreWeave anticipates raising billions in its upcoming IPO, applying to list its Class A common Stock on the Nasdaq Stock Market under the symbol CRWV.

The need for funds from this IPO arises since scaling a cloud computing business requires substantial capital. In 2024 alone, CoreWeave spent $8.7 billion on capital expenditures and ended up with a negative $6 billion in free cash flow. To support this initial outlay, the company has incurred a total debt of $7.9 billion.

In its S-1 filing with the Securities and Exchange Commission (SEC), management detailed $15.1 billion in remaining performance obligations from existing customers, poised to generate revenue over the upcoming years. While this is promising, it does not guarantee revenue will materialize. Notably, 62% of CoreWeave’s revenue in 2024 is dependent on Microsoft, a competitor that could potentially redirect its cloud spending internally if demand diminishes. A broader slowdown in AI spending could pose serious challenges for CoreWeave, creating risks that could impact its financials quickly.

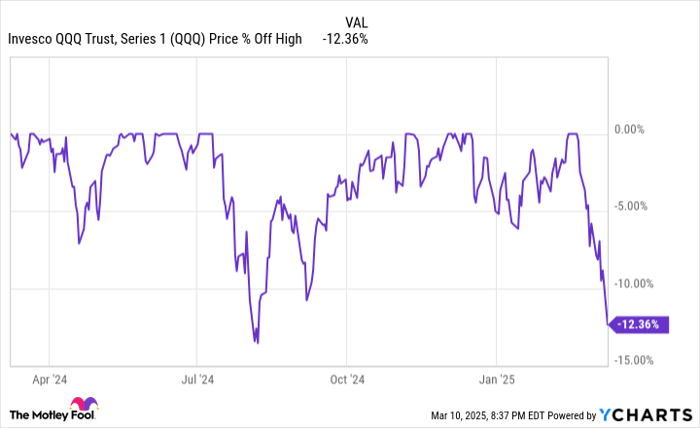

QQQ data by YCharts

Evaluating the CoreWeave IPO: What Investors Should Consider

Unless the recent market downturn, with the Nasdaq Composite experiencing a correction of over 10% from its recent peak, persists for an extended period, CoreWeave’s IPO is likely to launch with a premium valuation. Anticipation surrounding this IPO is considerable, given its status as the first generative AI-focused Stock to hit public markets; the Stock could see substantial price appreciation on its first trading day.

This does not imply investors should rush to buy the IPO. CoreWeave will probably enter the market with a premium valuation while facing a significant debt load alongside burning $6 billion annually in free cash flow. This situation is concerning. The heavy reliance on Microsoft for over half of its revenue—while also being a competitor—adds another layer of risk. This startup environment is immature, with potential pitfalls that could jeopardize CoreWeave’s Stock performance in the coming years. Savvy investors may want to observe market developments rather than succumb to hype.

Typically, cautious stock strategies advise against IPO stocks. This one is no different, as many IPOs underperform the market during their first year due to restrictive lockup periods and subsequent insider selling that may occur. The same could happen to CoreWeave. Even if the business appears intriguing, it might be wise to keep it on a watchlist for the foreseeable future.

Final Words on Investment Opportunities

Do you sometimes feel you’ve missed the chance to invest in the top-performing stocks? If so, consider this.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies they believe are poised for substantial gains. If you’re concerned about missing out on investment opportunities, now may be the ideal moment to act before it becomes too late. The historical performance is compelling:

- Nvidia: An investment of $1,000 from our double down in 2009 could yield $315,521!*

- Apple: A $1,000 investment when we doubled down in 2008 would grow to $40,476!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you could have $495,070!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, presenting a potential opportunity not to be overlooked.

Continue »

*Stock Advisor returns as of March 14, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on The Motley Fool’s board. Brett Schafer holds positions in Alphabet and Amazon. The Motley Fool has stakes in and recommends Alphabet, Amazon, Microsoft, and Nvidia. Additionally, The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool upholds a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily represent those of Nasdaq, Inc.