Boeing Stock Trends

Boeing stock (NYSE: BA) has taken investors on a tumultuous ride lately, seeing a decline of 10% from $215 in early January 2021 to around $190 currently. The S&P 500, in contrast, has soared approximately 40% over the same period, underscoring Boeing’s underperformance. A key driver of this lag is the 30% drop in Boeing’s Price-to-Sales (P/S) ratio, falling from 2.1x late last year to 1.5x now. The year 2024 has been harsh for Boeing with stock values plummeting by 25% year-to-date, largely due to the lingering 737 MAX challenges.

Comparing Performances

Boeing’s stock rollercoaster showcases a -6% return in 2021, -5% in 2022, and a sudden 37% leap in 2023. Conversely, the S&P 500 charted a 27% gain in 2021, -19% dip in 2022, and a 24% rise in 2023. This reflects Boeing’s struggle to outshine the broader market, a challenge shared by other big players in diverse sectors.

A Glimmer of Hope

Despite the recent turbulence, Boeing’s valuation appears tempting at current levels. Revenue growth shown by the company is a promising sign, with $77.8 billion in 2023, up 34% from $58.2 billion in 2020. The Commercial Airplanes segment led this charge with a 2x rise, while Global Services sales jumped 23%. Unfortunately, Defense, Space & Security sales faced a 5% decline over this duration.

Clouds on the Horizon

However, a series of incidents, including a cabin panel detaching midair and FAA audit failures on 737 MAX planes, have clouded Boeing’s path. The subsequent grounding of Boeing 737 Max 9 aircraft and reports of quality issues suggest looming delivery delays in 2024. Amid these challenges, Boeing is considering acquiring Spirit AeroSystems, a move aimed at addressing quality concerns and ramping up production to reach its 2026 target of 600 737 aircraft.

Looking Ahead

Despite these setbacks, analysts maintain a bullish outlook on Boeing’s stocks, setting a valuation of $259 per share, indicating a potential 35% upside from the current price. While short-term challenges persist, Boeing’s robust backlog, exceeding $500 billion, coupled with a strong market demand for new aircraft, could pave the way for solid long-term gains.

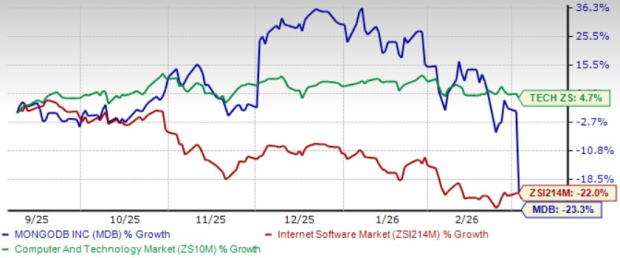

Peer Comparisons

For investors eyeing Boeing, it may be worth assessing how the company’s peers are faring. A glance at Boeing’s peers’ performance metrics could offer valuable insights into its potential trajectory amidst industry headwinds and market dynamics.