“`html

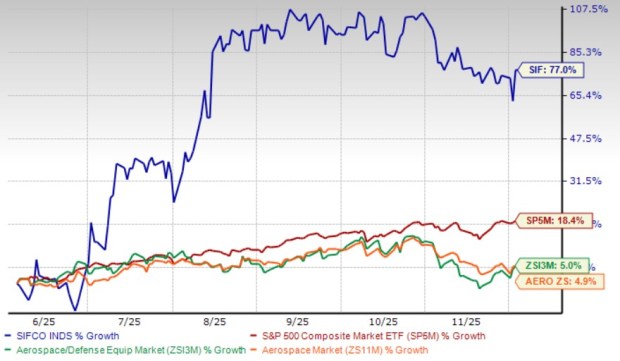

SIFCO Industries, Inc. reported a 77% increase in stock price over the past six months, significantly outperforming the aerospace and energy (A&E) market, which rose only 5%. The company, based in Cleveland, OH, announced its third-quarter fiscal 2025 results in August, showing marked improvements in both revenue and earnings. Sales remained solid, supported by increased production from A&E customers despite ongoing supply-chain constraints that affected shipment volumes.

Management highlighted an expanding backlog of orders, driven by recovery in the aerospace sector, which provides a clearer path for production and deliveries. SIFCO’s trailing 12-month EV/Sales ratio stands at 0.5X, notably lower than the industry average of 10.7X, suggesting potential for future growth as the company continues to streamline operations and enhance liquidity.

While SIFCO’s fundamentals remain strong, challenges include ongoing supply-chain issues that may hinder shipment flow and a sensitive capital structure that relies on lender terms. The company’s proactive refinancing and repositioning efforts have, however, strengthened its market capabilities.

“`