“`html

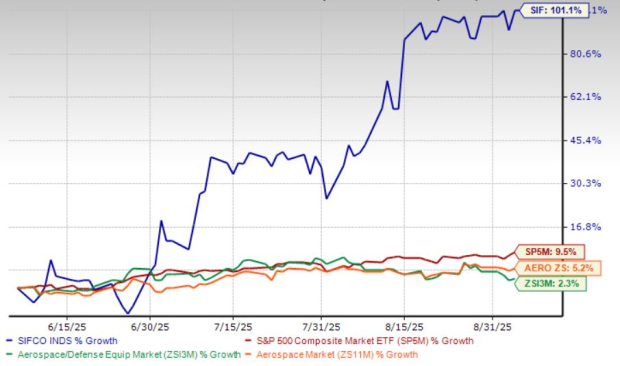

SIFCO Industries, Inc. (SIF), based in Cleveland, OH, has seen its stock surge 101.1% over the past three months, significantly outperforming the aerospace and defense industry average gain of 2.3% and the S&P 500’s 9.5%. The company reported improved fiscal third-quarter results in August 2025, showcasing strong profitability despite only a slight increase in sales due to effective cost management.

Demand for SIFCO’s forgings and machined components has remained robust, particularly from aerospace and energy end-users. However, supply chain constraints continue to impact shipment schedules. The company’s trailing 12-month EV/Sales ratio stands at 0.5X, below the industry average of 11.3X, indicating potential for future growth.

Despite some ongoing challenges, including lingering debt obligations and raw material supply issues, SIFCO’s operational initiatives have led to an enhanced profitability profile, providing the company with greater financial flexibility for reinvestment.

“`