Vanguard Total Stock Market ETF Sees $2 Billion Inflow This Week

This week, notable changes in shares outstanding are evident among the ETFs tracked by ETF Channel. The Vanguard Total Stock Market ETF (Symbol: VTI) reported an impressive inflow of about $2.0 billion. This marks a 0.4% increase in outstanding units, rising from 1,590,112,901 to 1,596,915,528.

Market Performance of Key Components

Within VTI’s largest holdings, we see varying performances for major players today. Tesla Inc (Symbol: TSLA) has seen a decline of roughly 2.9%. Broadcom Inc (Symbol: AVGO) follows closely with a drop of about 2.7%. Meanwhile, Berkshire Hathaway Inc New (Symbol: BRK.B) is down by approximately 0.6%. To explore all holdings, visit the VTI Holdings page.

Analyzing VTI Price Performance

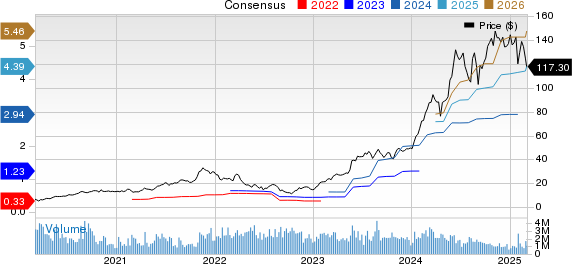

The chart below illustrates VTI’s price performance over the past year in comparison with its 200-day moving average:

Stock Market ETF 200 Day Moving Average Chart” src=”https://secure.tickertech.com/pics/2025/40773131921.gif”>

Observing the chart, VTI’s 52-week low stands at $244.57, while the 52-week high is $303.3904, with a recent trade recorded at $284.33. Examining the current share price against the 200-day moving average can serve as a beneficial technical analysis method. Learn more about the 200-day moving average here.

Free report: Explore Top 8%+ Dividends (paid monthly)

Understanding ETF Trading Mechanics

ETFs function similarly to stocks, though investors buy and sell ”units” instead of ”shares”. These units can fluctuate in availability based on investor interest. Each week, we analyze changes in shares outstanding to identify ETFs with significant inflows or outflows. When new units are created, the ETF must purchase the underlying assets. Conversely, when units are closed, the ETF sells its holdings. Consequently, substantial inflows or outflows can influence the individual components within ETFs.

![]() Click here to discover which 9 other ETFs experienced notable inflows this week.

Click here to discover which 9 other ETFs experienced notable inflows this week.

Additionally see:

- The Ten Worst ETF Performers

- GIPR Stock Predictions

- DISV Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.