Utilities Select Sector SPDR Fund Sees Notable Inflows This Week

In this week’s review of week-over-week changes in shares outstanding among ETFs tracked by ETF Channel, the Utilities Select Sector SPDR Fund (Symbol: XLU) stands out with an approximate inflow of $389.4 million. This represents a 2.2% increase in outstanding units, rising from 223,524,160 to 228,424,160.

Market Performance of XLU Components

Looking at the fund’s largest underlying holdings today, American Electric Power Co Inc (Symbol: AEP) declined by about 0.6%. In contrast, Sempra (Symbol: SRE) increased about 1.5%, while Dominion Energy Inc (Symbol: D) remained relatively unchanged. For a detailed list of holdings, check the XLU Holdings page »

Price Performance and Technical Analysis

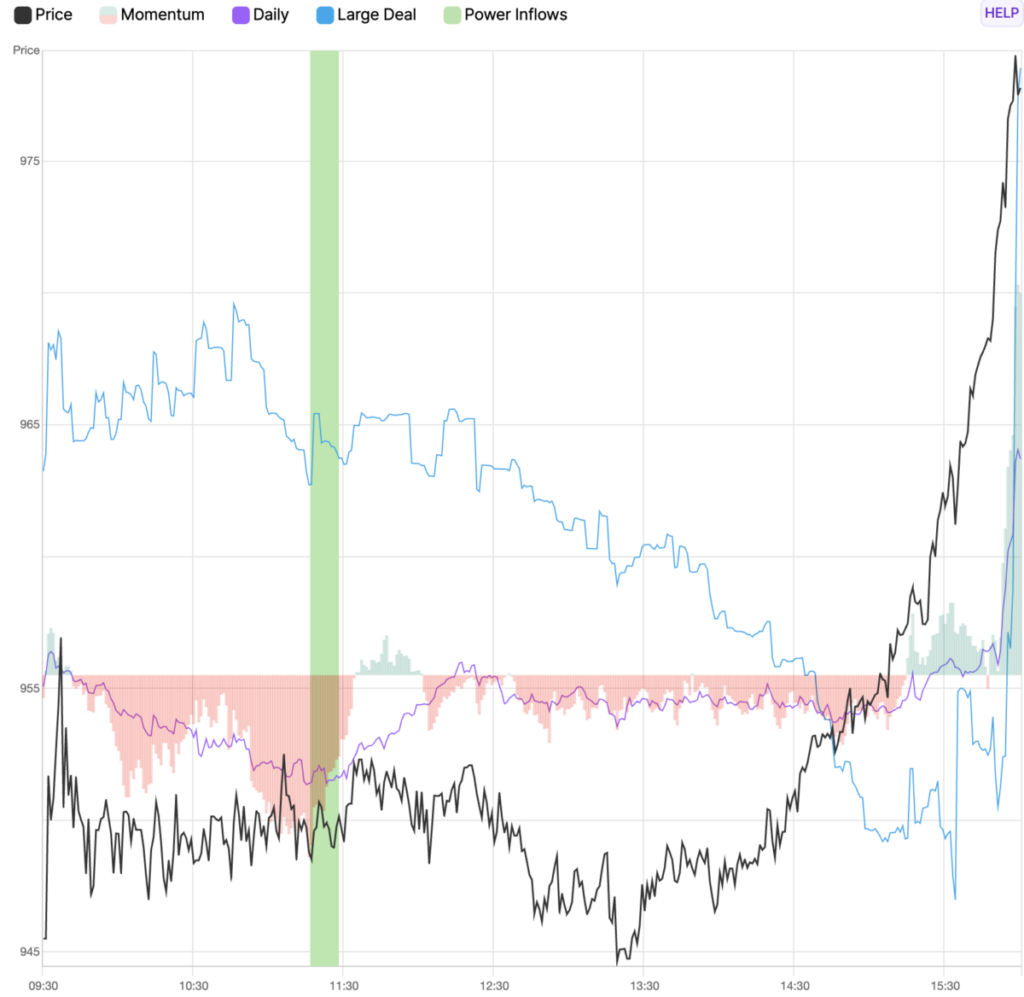

The chart below illustrates the one-year price performance of XLU in relation to its 200-day moving average:

XLU reached a low of $60.85 in its 52-week range and a high of $83.41, with a recent trade price of $80.18. Evaluating the recent share price against the 200-day moving average can offer additional insights for technical analysis—more details about the 200-day moving average can be found here.

Understanding ETF Flows and Their Impact

It’s important to note that exchange-traded funds (ETFs) function similarly to stocks, but instead of “shares,” investors buy and sell “units.” These units can be traded like stocks and can also be created or destroyed to meet investor demand. Each week, we track the changes in shares outstanding to identify ETFs experiencing significant inflows (indicating new units created) or outflows (indicating many units destroyed). When new units are created, the ETF’s underlying holdings must be purchased. Conversely, when units are destroyed, the underlying holdings are sold, making large flows impactful on the components within ETFs.

![]() Click here to see which nine other ETFs had notable inflows »

Click here to see which nine other ETFs had notable inflows »

Also see:

- HE YTD Return

- MCS Price Target

- DXJT Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.