Vanguard Intermediate-Term Bond ETF Sees Significant Inflows

Over $630 Million Added in a Week Signals Investor Confidence

In recent analysis of ETF performance, the Vanguard Intermediate-Term Bond ETF (Symbol: BIV) stands out with an impressive inflow of approximately $631.7 million. This reflects a week-over-week increase of 3.3% in outstanding units, rising from 254,954,060 to 263,354,060.

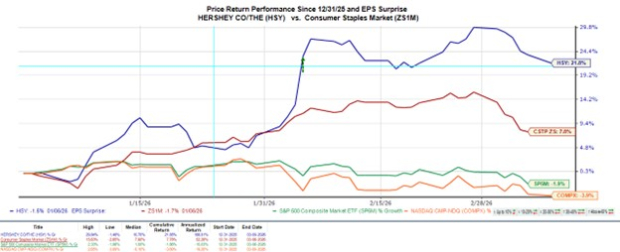

The accompanying chart illustrates BIV’s price performance over the past year, compared against its 200-day moving average:

Examining the chart, BIV reached a low of $71.91 per share and a high of $78.89 in the past 52 weeks, with its most recent trading price at $75.63. Evaluating the current share price against the 200-day moving average can provide investors with valuable insights regarding market trends.

Free Report: Top 8%+ Dividends (paid monthly)

Exchange-traded funds (ETFs) operate similarly to stocks; however, investors buy and sell “units” instead of shares. These units are flexible, as they can be created or eliminated based on demand. Each week, we track changes in shares outstanding to identify ETFs with notable inflows (new units created) or outflows (existing units destroyed). The generation of new units requires purchasing the underlying assets of the ETF, while the elimination of units entails selling these assets, potentially influencing the individual securities held within the ETFs.

![]() Click here to discover which 9 other ETFs experienced significant inflows »

Click here to discover which 9 other ETFs experienced significant inflows »

Also explore:

- Constellation Brands RSI

- Lennar 13F Filers

- Institutional Holders of BGG

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.