SPDR S&P MIDCAP 400 ETF Sees $203.4 Million Outflow

This week, the SPDR S&P MIDCAP 400 ETF Trust (Symbol: MDY) experienced a notable shift in shares outstanding. A significant outflow of approximately $203.4 million indicates a 1.0% decrease, bringing the total shares from 41,166,333 down to 40,741,333.

Among MDY’s largest underlying components, several companies are showing positive price movements today. Interactive Brokers Group Inc – Class A (Symbol: IBKR) is up 7.4%, Watsco Inc. (Symbol: WSO) has increased by 3.4%, and Casey’s General Stores, Inc. (Symbol: CASY) is up approximately 3.7%. For additional details on all holdings, visit the MDY Holdings page.

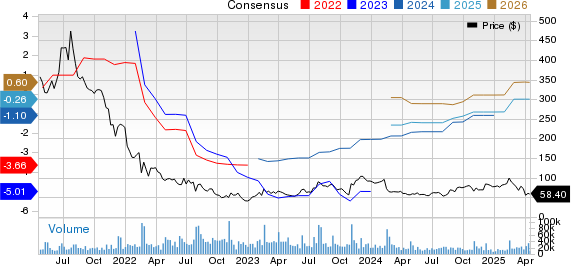

The chart below illustrates the one-year price performance of MDY compared to its 200-day moving average:

MDY has navigated a 52-week price range with a low of $458.82 per share and a high of $624.125, currently trading at $493.72. This comparison against the 200-day moving average can offer insights for technical analysis—learn more about the 200-day moving average.

Exchange-Traded Funds (ETFs) function similarly to stocks, but investors trade “units” instead of “shares.” These units can be exchanged on the market and, depending on demand, may be created or destroyed. Monitoring week-over-week changes in shares outstanding helps identify ETFs with significant inflows (new unit creation) or outflows (unit destruction). Increased creation of units necessitates buying underlying holdings, while destruction involves selling them. This can affect the individual components within these ETFs.

![]() Click here to discover which 9 other ETFs have experienced notable outflows.

Click here to discover which 9 other ETFs have experienced notable outflows.

See also:

- Institutional Holders of BITI

- Top Ten Hedge Funds Holding KMPR

- SYK Next Dividend Date

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.