By RoboForex Analytical Department

Brent Crude Oil Prices Plummet Following Eased Tensions in the Middle East

Brent crude oil prices have experienced a notable decline, settling at 71.46 USD per barrel on Tuesday. Earlier in the week, prices dropped nearly 6%, marking the largest single-day fall in two years. This decrease reflects market reactions to recent developments in the Middle East, where tensions have abated somewhat.

Shifting Geopolitical Landscape Influences Prices

Over the weekend, Israel’s measured response to Iran, which notably spared oil facilities and nuclear sites, has significantly lowered the perceived risk of supply disruptions. Additionally, Israeli officials indicated a willingness to discuss a temporary ceasefire in the Gaza Strip in exchange for the release of hostages. This diplomatic approach has further lessened some of the geopolitical fears that were previously driving up oil prices.

Focus Shifts to Economic Indicators and OPEC Production

With the immediate dangers in the Middle East waning, attention has returned to the underlying economic weaknesses in China and the ongoing production levels within OPEC. Additionally, upcoming U.S. employment data will be closely observed as it may offer insights into the Federal Reserve’s future interest rate decisions. Analysts anticipate two additional rate cuts of 25 basis points each before year-end, a scenario that could generally benefit the energy sector, although much of this expectation has already been integrated into current market prices.

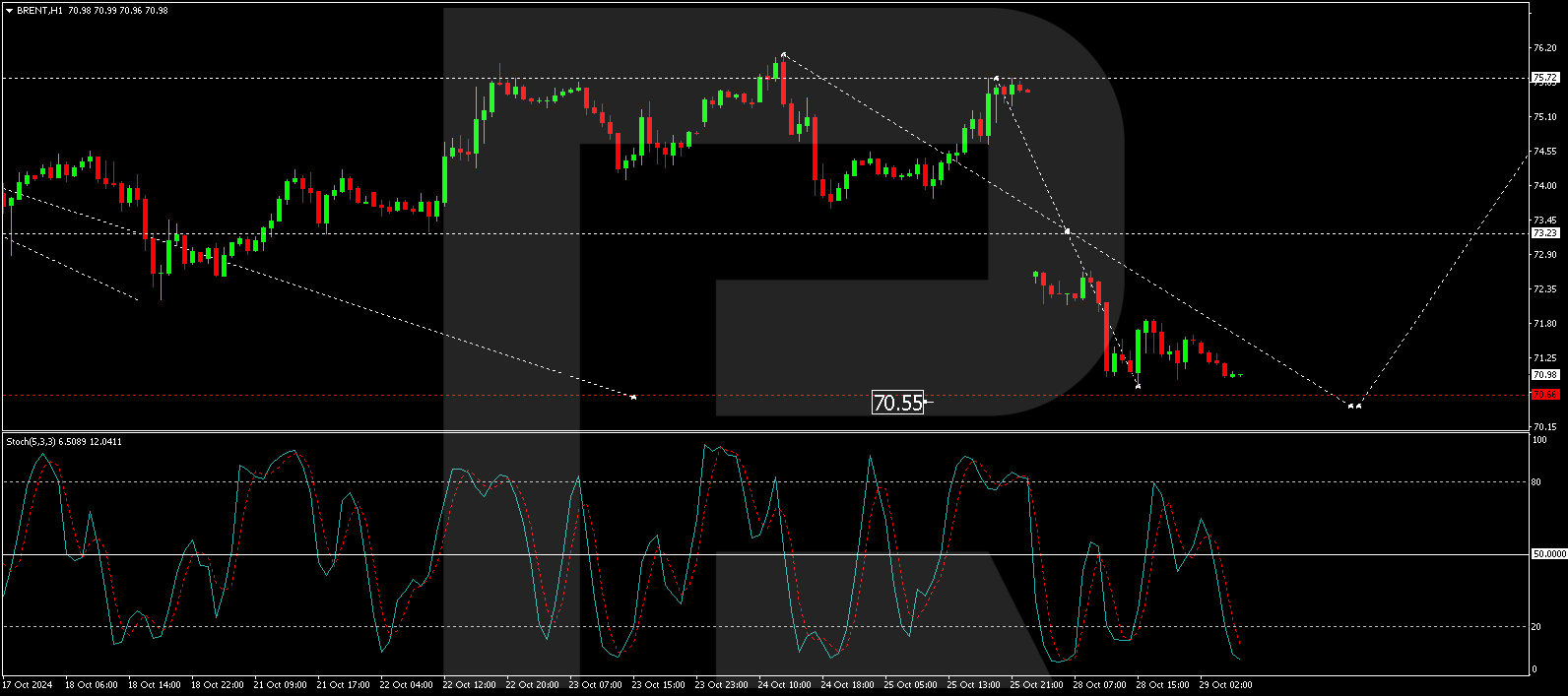

Technical Analysis of Brent

Currently, Brent crude is constructing a corrective pattern aimed at the 70.55 USD level. If this target is reached, a rebound towards 75.75 USD could be anticipated. A break above this threshold may open the door for a rally to 80.90 USD, with further potential to reach as high as 85.85 USD. This bullish perspective is supported by the MACD indicator, which shows the signal line below zero, indicating prospects for an upward movement.

On the hourly chart, Brent appears to be finalizing its correction toward 70.50 USD, currently forming the fifth wave of this corrective phase. Once the target of 70.50 USD is reached, focus will shift to a new growth wave, targeting 73.23 USD as the next milestone. This optimistic outlook for Brent is further validated by the Stochastic oscillator, which indicates a potential upward correction with its signal line currently below 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs